[[{“value”:”

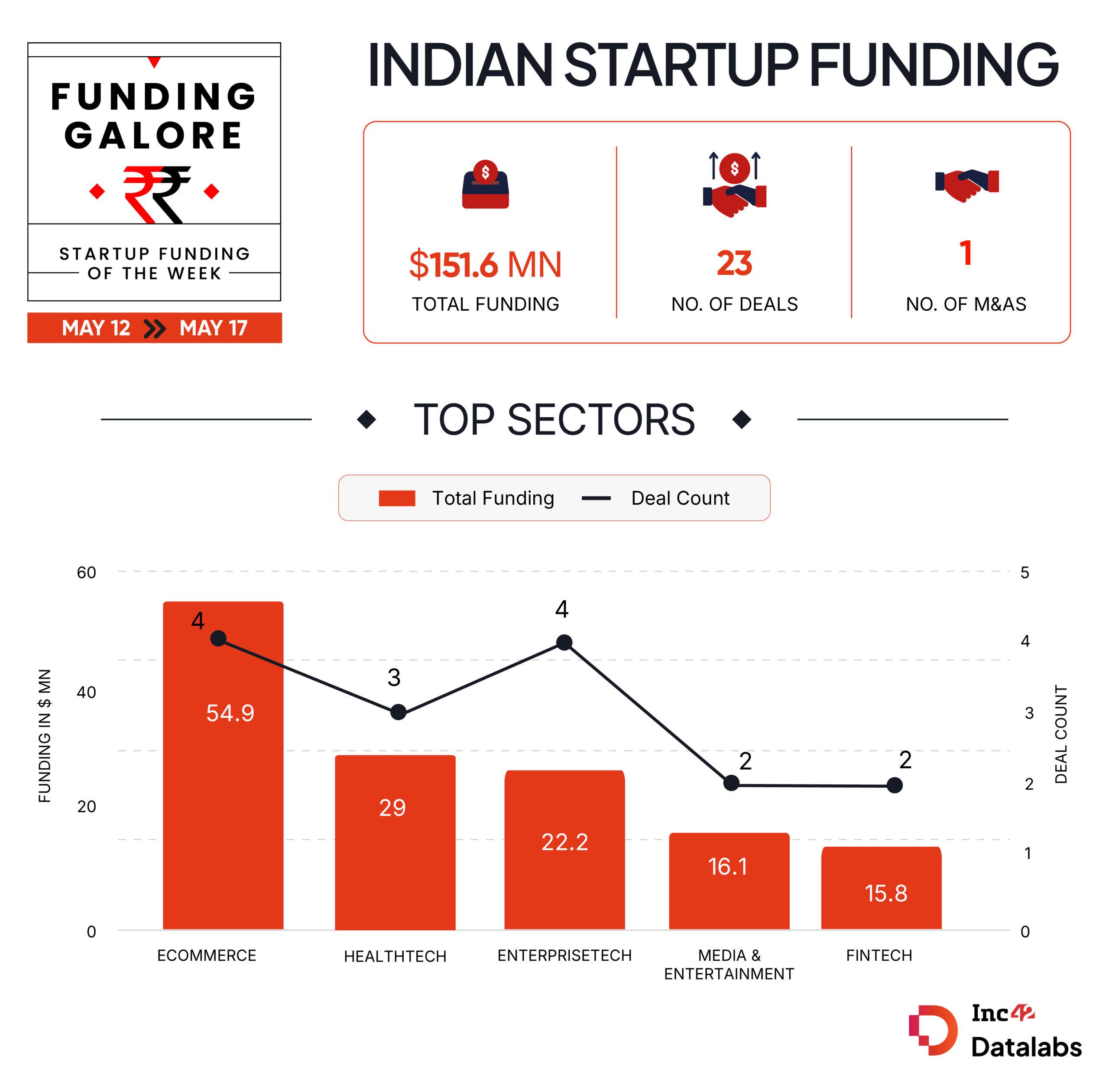

After a week of spike, funding trends in the Indian startup ecosystem dwindled again in the second week of the ongoing month. Between May 12 and 17, startups cumulatively raised $151.6 Mn across 22 deals, marking a 74% decline from the $587 Mn raised by 27 startups in the previous week.

The decline in the funding primarily comes due to a dearth of large-ticket transactions. D2C snacking brand Farmley secured the biggest cheque of $40 Mn this week, as against the $218 Mn funding raised by PB Health last week.

Meanwhile, the week was rife with developments like announcements of new fund launches, secondary deals and of startups taking the next step to raise from the public markets.

With that said, here’s a look at the key highlights on the funding front in the world’s third largest startup ecosystem this week.

Funding Galore: Indian Startup Funding Of The Week [May 12 – 17]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 12 May 2025 | Farmley | Ecommerce | D2C | B2C | $40 Mn*** | Series C | L Catterton, DSG Consumer Partners, BC Jindal Group | L Catterton |

| 14 May 2025 | Complement1 | Healthtech | Healthcare Services | B2C | $16 Mn | Seed | Owl Ventures, Blume Ventures | Owl Ventures, Blume Ventures |

| 12 May 2025 | Celebal | Enterprise Tech | Horizontal SaaS | B2B | $15 Mn | Series B | InCred Growth Partners Norwest Capital | – |

| 13 May 2025 | Flam | Media & Entertainment | – | B2B | $14 Mn | Series A | RTP Global, Dovetail | RTP Global |

| 15 May 2025 | Hocco | Ecommerce | D2C | B2C | $10 Mn* | Series B | Chona family office, Sauce.vc | Chona family office, Sauce.vc |

| 12 May 2025 | Avammune Therapeutics | Healthtech | Healthcare Services | B2C | $12 Mn | Series A | Capital 2B, Shastra VC, Kotak Alternate Asset Managers, IvyCap Ventures, 1Crowd | Capital 2B, Shastra VC, Kotak Alternate Asset Managers |

| 13 May 2025 | Stashfin | Fintech | Lending Tech | B2C | $9.3 Mn | Debt | Northern Arc, Coinmen Special Opportunities Fund | – |

| 13 May 2025 | Hyperbots | Fintech | Fintech SaaS | B2B | $6.5 Mn | Series A | Arkam Ventures, Athera Venture Partners, JSW Ventures, Kalaari Ventures, Sunicon Ventures, Darashaw & Company | Arkam Ventures, Athera Venture Partners |

| 13 May 2025 | Adopt AI | Enterprise Tech | Horizontal SaaS | B2B | $6 Mn | Seed | Elevation Capital, Foster Ventures, Powerhouse Ventures, Darkmode Ventures | Elevation Capital |

| 13 May 2025 | Biryani Blues | Consumer Services | Hyperlocal Delivery | B2C | $5 Mn | Pre-Series C | Yugadi Capital | Yugadi Capital |

| 14 May 2025 | BlueStone | Ecommerce | D2C | B2C | $4.7 Mn | Debt | BlackSoil, Caspian Impact Investments | – |

| 13 May 2025 | TIEA Connectors | Deeptech | IoT & Hardware | B2B | $2.6 Mn | – | Jamwant Ventures, Valour Capital, 8X Ventures, IvyCap Ventures | Jamwant Ventures, Valour Capital |

| 14 May 2025 | ReelSaga | Media & Entertainment | OTT | B2C | $2.1 Mn | Seed | Picus Capital, ITI Growth Opportunities Fund, Nazara Technologies, 8i Ventures, Waveform Ventures, Warmup Ventures, Bombay54, Bharat Founders Fund | Picus Capital |

| 15 May 2025 | Zenergize | Cleantech | Electric Vehicles | B2B | $2 Mn | Seed | Mohit Tandon, Himanshu Aggarwal | Mohit Tandon, Himanshu Aggarwal |

| 16 May 2025 | Pronto | Consumer Services | Hyperlocal Services | B2C | $2 Mn | – | Bain Capital Ventures | Bain Capital Ventures |

| 15 May 2025 | Rohal Technologies | Cleantech | Climate Tech | B2B | $1 Mn | Seed | India Accelerator | India Accelerator |

| 14 May 2025 | MedVital | Healthtech | Medtech | B2B | $981K | Pre-Seed | 4point0 Health Ventures | 4point0 Health Ventures |

| 14 May 2025 | ContraVault AI | Enterprise Tech | Enterprise Services | B2B | $596K | Seed | Titan Capital, Rajiv Ahuja, Haresh Chawla, Jaswinder Ahuja, Dilipkumar Khandelwal, Abhishek Goyal | Titan Capital |

| 14 May 2025 | Third Bracket | Enterprise Tech | Horizontal SaaS | B2B | $584K | Seed | – | – |

| 13 May 2025 | LUZO | Consumer Services | Hyperlocal Services | B2C | $550K | Seed | Enrission India Capital | Enrission India Capital |

| 15 May 2025 | Naptapgo | Travel Tech | Accommodation | B2C | $234K | Pre-Seed | Inflection Point Ventures | Inflection Point Ventures |

| 13 May 2025 | Be Clinical | Ecommerce | D2C | B2C | $234K | Seed | Titan Capital, Aditya Agrawal | Titan Capital |

| 13 May 2025 | Neurostellar | Deeptech | IoT & Hardware | B2B | $150K | – | Swapnil Jain, Tarun Mehta | – |

| Source: Inc42 *Part of a larger round **Included this week as it was skipped last week *** Includes both primary and secondary deal Note: Only disclosed funding rounds have been included “ |

||||||||

Key Startup Funding Highlights Of The Week

- On the back of Farmley’s $40 Mn funding round, ecommerce emerged as the most funded startup sector this week. Four startups in the segment raised $54.9 Mn in the week.

- Enterprise tech also saw an equal number of deals materialise this week as ecommerce. Four startups in the segment raised $22.2 Mn in the week.

- IvyCap Ventures and Titan Capital were the most active investors this week, backing two startups apiece.

- Seed funding plunged to $29.8 Mn raised by 11 startups this week as against $227.4 Mn raised by startups at this stage last week.

Startup IPO Developments This Week

- Groww is likely to take the confidential route to file its DRHP for an IPO that could value it in a range of $7 Bn to $8 Bn within two weeks via a confidential route.

- In route to filing for a INR 1,500 Cr IPO, Curefoods converted into a public entity this week.

- IPO-bound fintech unicorn Moneyview is said to have roped in Axis Capital, Kotak Mahindra Capital Company, among others, as bankers for its $400 Mn IPO.

Fund Updates Of The Week

- Former X India head Manish Maheshwari’s BAT VC announced its India foray with the launch of a $100 Mn fund to back early stage ventures in the country this week.

- Early-stage focussed VC Kriscore Capital marked the first close of its maiden INR 100 Cr ($11.7 Mn) fund. The VC plans to back 16-18 tech startups with the fund.

Other Developments Of The Week

- Enterprise tech Capillary Technologies bought Kognitiv for an undisclosed amount this week to expand its global footprint and strengthen its position in the North American market.

- Groww signed a definitive agreement to acquire Fisdom in an all-cash deal valuing the latter at $150 Mn. Meanwhile, Singapore’s GIC also sought CCI’s approval to acquire a 2.1% stake in the IPO-bound startup this week.

- Dream11 shared plans of investing $50 Mn in Times Internet-owned Cricbuzz to deepen its play in the cricket content and broadcast ecosystem.

- Motilal Oswal’s founders Motilal Oswal and Raamdeo Agrawal joined Zepto’s cap table through a $100 Mn secondary deal this week.

- Listed dronetech major DroneAcharya and competitor AITMC Ventures have paused their merger plans to re-evaluate the term sheet and focus on the current market opportunities separately.

The post From Farmley To Stashfin — Indian Startups Raised $152 Mn This Week appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media