[[{“value”:”

-

Crypto market enjoys liquidity inflows; Bitcoin enters price discovery as liquidity bleeds out of the stock market.

-

Why the latest Moody’s ratings downgrade of the U.S has influenced the market outcome.

-

Michael Novogratz chimes in on U.S debt related concerns

-

Exchange inflows on the rise. Will sell pressure take over?

The crypto market has seen more liquidity injection so far this week and the impact is evident. Bitcoin soared above $111,000 and most altcoins also enjoyed a significant bullish boost.

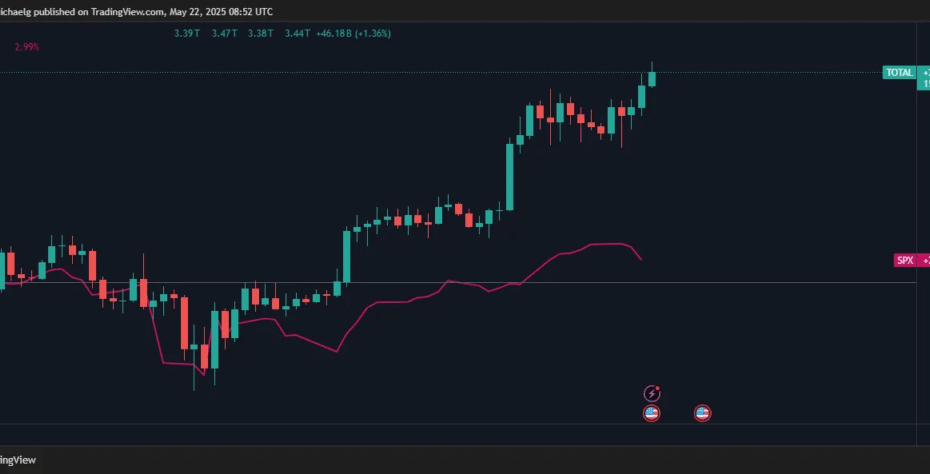

More importantly, the crypto market appears to have decoupled from the S&P500. The latter has been declining since Monday, while the crypto market continued to carry a bullish momentum.

The crypto market grew in its totality from $3.17 trillion at its lowest point this week (Monday) to as high as $3.47 trillion in the last 24 hours. Meanwhile, the S&P500 was down by almost 2% from 5,981 to 5,859 at the time of observation.

This is the second time this year that the crypto market has deviated from its correlation with the U.S stock market. The last time it was influenced by the U.S-China tariff wars and crypto was able to detach because it was isolated from the tariffs-related economic impacts.

Here’s why the crypto market is decoupling from U.S stock market correlation?

The decoupling between stocks and cryptocurrencies in April was mostly due to economic concerns and similar concerns underpin the latest decoupling. The S&P500 owed its recent decline to concerns due to the U.S credit rating downgrade by Moody’s.

The credit rating agency cited the U.S growing debt burden as a major concern. Many investors saw the ratings downgrade a negative sign for investment hence the stock market’s reaction.

The ratings downgrade was not only a reminder of the rising economic concerns associated with unsustainable U.S debt. It also meant borrowing rates in the U.S were likely to go up.

Meanwhile, liquidity has been favoring the crypto market as evident by rallying crypto prices. Bitcoin managed to push to a new historic top above $111,000 as institutional liquidity floods in.

The market reaction could signal that investors are looking at the crypto market and especially BTC from a safe haven perspective. This is likely because Bitcoin’s operations are not tied to the stock market and are therefore not impacted by the same economic concerns.

Michael Novogratz chimes in on bullish factors for BTC

Bitcoin also owes its latest bullish price action to heavy institutional flows. Galaxy Digital’s CEO Michael Novogratz noted that the momentum really kicked off when BlackRock CEO Larry Fink embraced Bitcoin.

According to Novogratz, BlackRock’s aggressive BTC acquisitions also encouraged more institutions to join the trend. In addition, more institutional investors outside the U.S have also been following the same trend.

The Galaxy CEO also noted that the rising debt concerns have also been favorable for the crypto market. While this confirmed crypto’s shift towards the uncorrelated side, will it be enough to continue fueling the bull run?

Volatility is likely to soar to new highs especially with Bitcoin pushing into price discovery. Profit taking in new highs was likely to be on the rise especially considering that most holders were in profit.

CryptoQuant exchange flow data already confirmed that exchange inflows were significantly higher than exchange outflows at the time of observation. A sign that some holders were taking profits.

It was also confirmation that demand cooled down significantly. In addition, BTC was deeply overbought. However, open interest moved closer to $80 million and sell-side expectations resulted in higher short liquidations.

According to Coinglass, Bitcoin shorts clocked in at $176 million in the last 24 hours. A sizable gap compared to $45 million in long liquidations. This suggests that the bullish momentum was still strong as whale and institutional liquidity continued to flood into the market.

Will the crypto market continue to benefit from liquidity inflows? Rising institutional involvement in the market could continue to fuel more confidence in the market but caution is still warranted given how rapid things change in the markets.

Link: https://www.thecoinrepublic.com/2025/05/22/crypto-market-detaches-from-sp-500-correlation-analysis-outlook/?utm_source=pocket_saves

Source: https://www.thecoinrepublic.com

The post Crypto market detaches from S&P 500 correlation appeared first on Fintech News.

“}]]

Read More  Fintech News

Fintech News