|

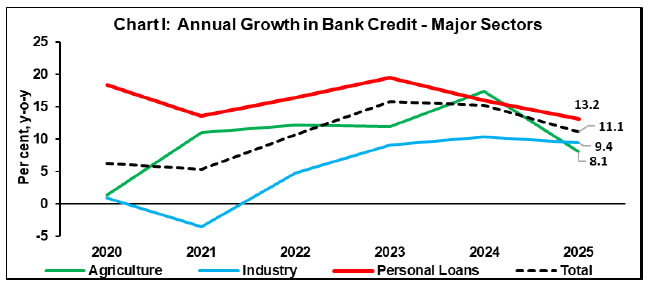

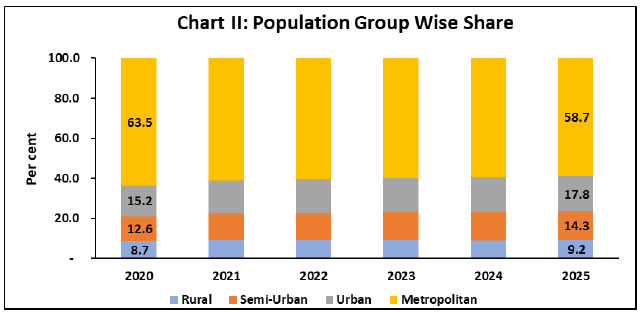

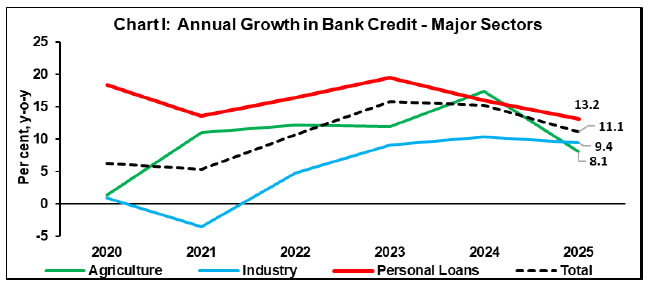

Today, the Reserve Bank released the web publication ‘Basic Statistical Return on Credit by Scheduled Commercial Banks (SCBs) in India – March 2025’1 on its ‘Database on Indian Economy’ (DBIE) portal2 (https://data.rbi.org.in Homepage > Publications). The publication provides information on various characteristics of bank credit in India, based on data submitted by SCBs {including Regional Rural Banks (RRBs)} under the annual ‘Basic Statistical Return (BSR) – 1’ system, which collects information on type of account, organisation, occupation/activity and category of the borrower, district and population3 group of the place of utilisation of credit, rate of interest, credit limit and amount outstanding. Highlights:

Ajit Prasad Press Release: 2025-2026/449 1 The previous annual BSR-1 series results on credit by SCBs (including RRBs) for March 2024 were released on the RBI website on June 4, 2024; the aggregates from quarterly BSR-1 for SCBs (other than RRBs) are being released regularly since December 2014. Accordingly, quarterly publication for March 2025 is also released (web-link: – https://data.rbi.org.in >Homepage > Publications>Basic Statistical Return (BSR)-1 – (Quarterly) – Outstanding Credit of Scheduled Commercial Banks) along with the annual BSR-1 March 2025. 2 Banking aggregates based on fortnightly Form-A Return (collected under Section 42(2) of the RBI Act, 1934) for the last reporting Friday of March 2025 were published earlier at our website (https://www.rbi.org.in >Home>Statistics>Data Release>Fortnightly>Scheduled Bank’s Statement of Position in India) and aggregate level monthly data on sectoral deployment of bank credit for March 2025, reported by select major banks, were also released on the website (Home>Statistics>Data Releases>Monthly> Data on Sectoral Deployment of Bank Credit). 3 Population group criteria used for BSR is based on population size of respective revenue centre, as per census 2011, where branches of SCBs are operating and classified as: a) ‘Rural’ (population less than 10,000), b) ‘Semi-urban’ (population of 10,000 to less than 1 lakh), c) ‘Urban’ (population of 1 lakh to less than 10 lakhs), d) ‘Metropolitan’ (population of 10 lakhs and above). 4 Reference date for BSR-1 is last day of the quarter. The growth figures used for comparison pertaining to March 2024 are adjusted of impact of merger of a non-bank with a bank with effect from July 1, 2023. 5 Personal loans include housing, education, vehicle, personal credit cards, consumer durables and other personal loans. |

Read More  PRESS RELEASES FROM RBI

PRESS RELEASES FROM RBI