[[{“value”:”

After skyrocketing in the middle of May, the Indian markets ended the month on a sombre note. Amid the final leg of Q4 earnings, stock-specific action was seen this week in 33 new-age tech companies under Inc42’s coverage.

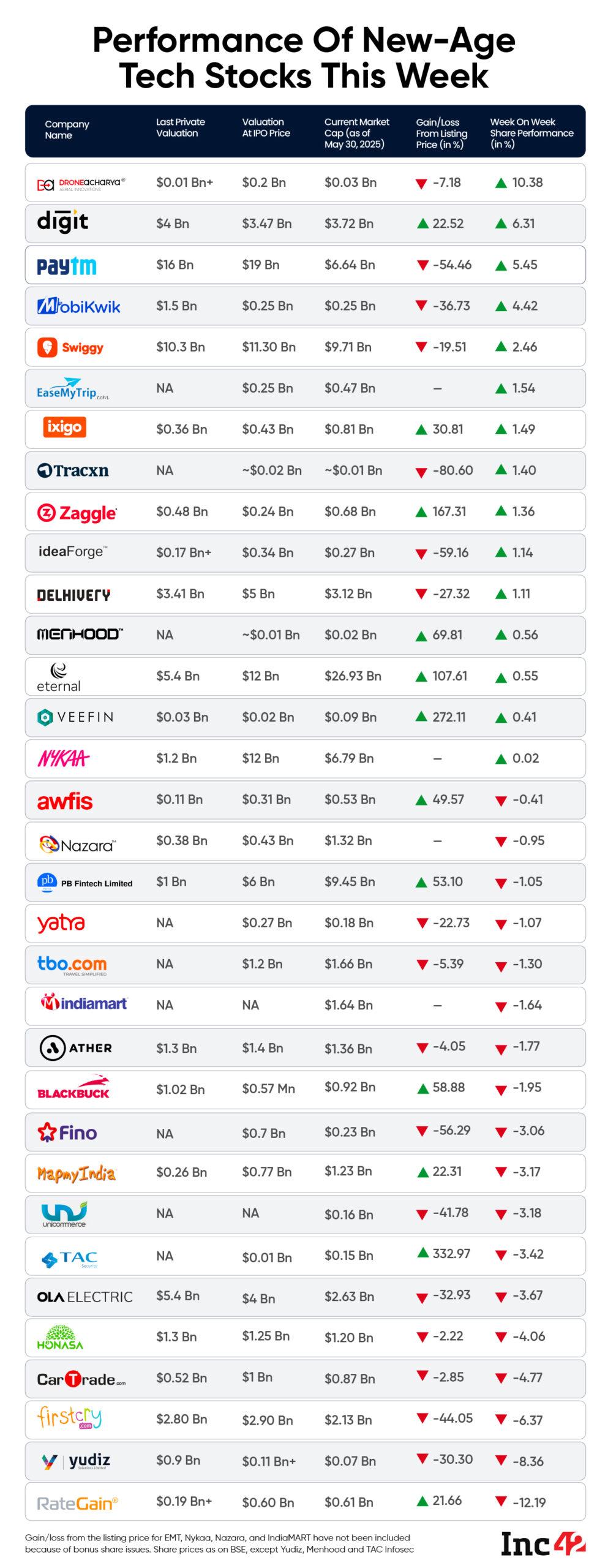

While 15 of the 33 new-age tech stocks ended in the green, gaining up to over 10%, 18 fell in a range of 0.41% to over 12%.

Dronetech company DroneAcharya emerged as the biggest gainer ahead of the release of its FY25 earnings, which was scheduled for Friday (May 30). However, the company didn’t disclose its results on the stipulated date and pushed it to June 6.

In an exchange filing, DroneAcharya said that its auditors were unable to submit its financial statements due to an “unforeseen situation”. During its board meeting on Friday, the BSE SME-listed company approved the acquisition of an additional 49% stake in DroneAcharya Miltech Pvt Ltd to make it a wholly owned subsidiary of the company.

In the list of gainers, Paytm jumped 5.45% to end the week at INR 890.30. The company’s shares saw a consistent bullish momentum throughout the week after it informed the bourses last week that INR 5,712 Cr GST notice for its gaming vertical was stayed by the Supreme Court.

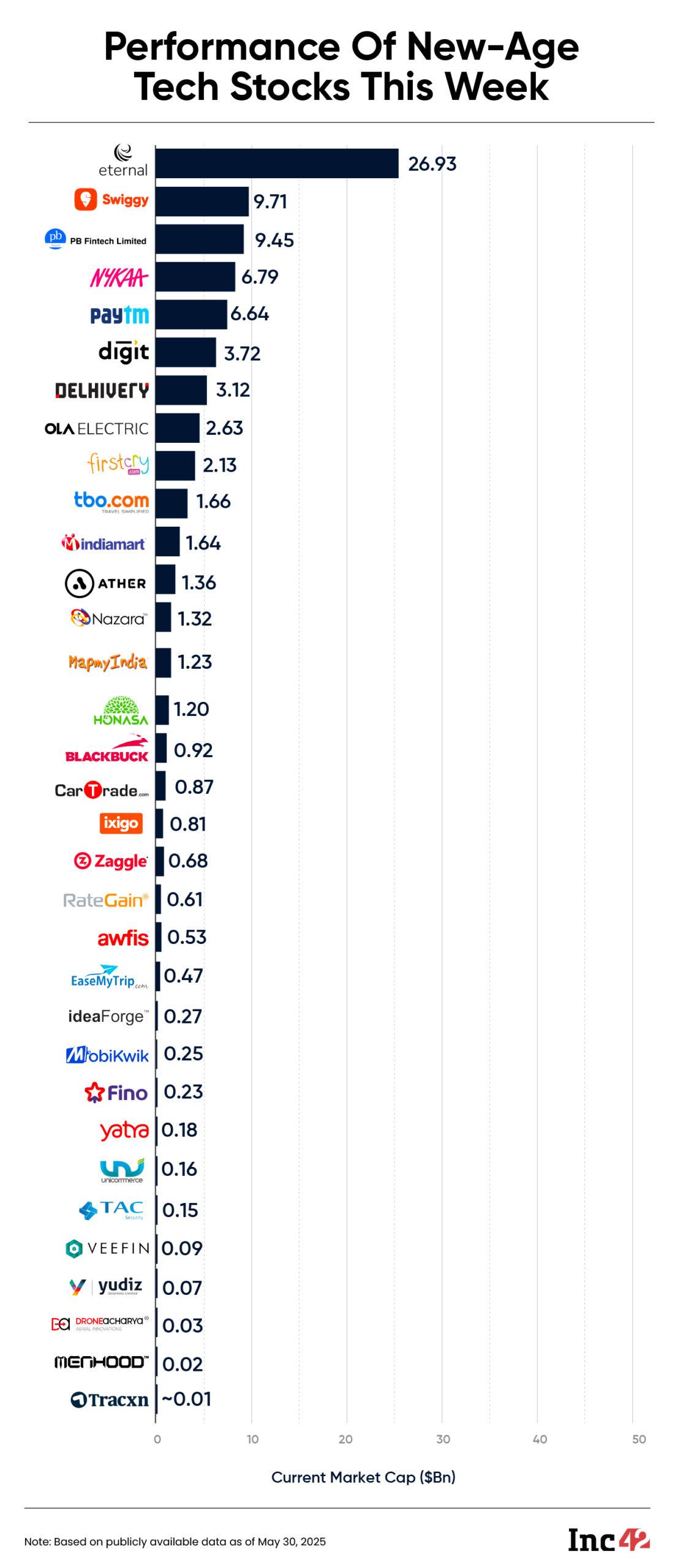

The list of gainers this week featured Eternal, Swiggy, Delhivery and Go Digit. As a result, the total market cap of the new-age tech companies stood at $85.88 Bn, down slightly from $85.93 Bn at the end of the previous week.

Meanwhile, shares of two companies, EaseMyTrip and Nykaa, that disclosed their results after market hours on Friday (May 30), ended the week slightly higher than the previous week. While EaseMyTrip’s shares gained 1.54% to end the week at INR 11.22, Nykaa rose a marginal 0.02% to end at INR 203.25.

The results of Tracxn, Awfis, Yatra, Nazara, BlackBuck, Ola Electric, FirstCry and RateGain failed to generate a positive response from investors this week. RateGain emerged as the biggest loser this week.

Now, let’s take a look at the performance of the broader market this week.

Lukewarm Trend Persists

The Indian equities market saw the second consecutive week of decline. While Sensex dipped 0.3% to end the week at 81,451.01, Nifty 50 fell 0.4% to end at 24,750.70.

Analysts attributed the fall to a lack of positive triggers in the domestic market. Besides, they said investors reacted to uncertainties over US tariff developments this week even as they awaited the decision of the RBI’s upcoming monetary policy meeting, scheduled for June 4-6.

Geojit Investments’ head of research Vinod Nair believes that the US president Donald Trump ‘s policy of announcing new tariffs and then putting a temporary pause shows that the global market will have to contend with macroeconomic concerns, which may continue to create ripple effects in the emerging markets.

However, he believes that a forecast for above average monsoon rains for India, a benign inflation trajectory, and Q4 GDP growth of 7.4% will help the Indian market.

Notably, the GDP data released this week showed the Indian economy grew 6.5% in FY25.

“The market is pricing in a 25 basis point cut (from the RBI), which will improve the outlook for rate-sensitive sectors. The positive macroeconomic scripts can boost investor sentiments, but stability in the broader market will be contingent on strong earnings growth and receding trade tensions,” he noted.

Ajit Mishra, SVP of research at Religare Broking, believes that MPC’s stance on rate trajectory, especially amid mixed macroeconomic signals, will be critical in shaping market direction.

“With the new month beginning, participants will track high-frequency data, including auto sales numbers and other economic indicators. Updates on the progress of the monsoon and the trend in foreign institutional investor (FII) flows will also be closely monitored. Globally, developments in the US bond market and any updates regarding ongoing trade negotiations will continue to influence investor sentiment,” he added.

Now, let’s take a look at the weekly performance of RateGain and FirstCry.

RateGain’s Weak Guidance Hits Investor Interest

Travel-focussed SaaS company RateGain’s shares slumped 12.19% this week to end at INR 443.8.

On Monday (May 26), RateGain reported a 9.6% increase in its net profit to INR 54.8 Cr in Q4 FY25 from INR 50 Cr in the year-ago quarter. Meanwhile, operating revenue grew 2% to INR 260.7 Cr during the quarter under review from INR 255.8 Cr in Q4 FY24.

For the full fiscal year, the company’s profit grew about 44% YoY to INR 208.9 Cr and revenue rose 12.5% YoY to INR 1,076.7 Cr.

The company said it expects its revenue to grow 6-8% in FY26, with EBITDA margin at sub-17%.

In a post-earnings call, the company’s management said that they view the ongoing fiscal year as a transition year, impacted by investments and new hires.

It is pertinent to note that while cutting its guidance for FY25 in November, RateGain had said that it lost a major mid-market hotel chain customer in the martech segment due to M&A. Besides, the company also cited a weak order pipeline, lower travel demand among specific markets, and pricing pressure on some large contracts as the reason behind it.

FirstCry Falls On Q4 Loss, BIS Troubles

Kids-focussed omnichannel retailer FirstCry’s shares plunged 6.37% to end the week at INR 348.9.

On May26, the company reported a 157.8% increase in its net loss to INR 111.5 Cr in Q4 FY25 from INR 43.3 Cr in the year-ago quarter. However, it is pertinent to mention that the company incurred a one-time exceptional loss of INR 36.7 Cr during the quarter under review.

Meanwhile, its operating revenue grew 15.8% to INR 1,930.3 Cr in Q4 FY25 from INR 1,666.8 Cr in the year-ago quarter.

For the full fiscal year FY25, its parent Brainbees Solutions’ loss declined 17.6% to INR 264.8 Cr from INR 321.5 Cr in FY24. Its top line rose 18.2% to INR 7,659.6 Cr from INR 6,480.9 Cr in FY24.

Besides, the company informed the bourses this week that the Bureau of Indian Standards (BIS) conducted search and seizure operations at one of its Bengaluru warehouses and seized goods worth INR 90 Lakh.

The BIS said that the company was not in compliance with its standard mark/hallmark with respect to a few of its products.

The post New-Age Tech Stocks See Another Mixed Week, RateGain Biggest Loser appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media