[[{“value”:”

Razorpay Flips Back, But At What Cost?

Razorpay’s move to redomicile to India ahead of its planned IPO is not going to be cheap. The fintech unicorn is likely to pay nearly $150 Mn (around INR 1,245 Cr) in taxes to Indian authorities and another $250 Mn-$300 Mn to the US government, pushing the total tax liability north of $400 Mn-$450 Mn.

In a bid to reduce this outgo, Razorpay has consolidated six Indian subsidiaries under a single local holding company. While it hopes to bring down the total tax payout to US authorities to around $200 Mn (INR 1,663 Cr), the combined cost of the flip could still hover around $350 Mn (around INR 2,994 Cr).

The Great Indian IPO Dream: The reverse flip is essential for Razorpay’s IPO, expected in FY27. As part of the process, the company became a public entity in March and merged its Delaware-based holding company with its Indian subsidiary to streamline its structure.

Hints Of A Tough Fiscal Year? In FY24, Razorpay posted a net profit of INR 33.5 Cr (up 365% YoY) and revenue of INR 2,475 Cr (up 9% YoY). But a tax payout of nearly INR 3,000 Cr is going to impact its profitability and erode cash reserves.

What Determines The Tax Slap: The amount of tax liable for shifting a domicile from one country to another is determined by the company’s valuation. Notably, Razorpay was valued at $7.5 Bn (INR 64,172 Cr) when it last raised funding of $375 Mn (INR 3,208 Cr) in 2021.

However, Razorpay isn’t alone under the tax gavel. PhonePe reportedly paid nearly INR 8,000 Cr in taxes for its reverse flip, while Groww has paid INR 1,340 Cr.

Now, with all eyes on Razorpay’s market debut, it would be interesting to observe how the fintech balances the financial strain of INR 1,245 Cr in taxes to the Indian government alone.

From The Editor’s Desk

Will India Swipe Up For Microdrama Apps? Bite-sized storytelling is gaining momentum in India as startups like Reelies and Kuku TV have pulled all stops to cash in on the receding attention span of Indians. Check out what’s fuelling India’s next big OTT boom.

Dull Week For New-Age Tech Stocks: Fifteen out of the 33 startup stocks under Inc42’s coverage ended last week in the green while the remaining fell in a range of 0.41% to over 12%. Paytm was the biggest gainer. It jumped 5.45% to end the week at INR 890.30.

Funding Dips: Indian startups cumulatively raised $93 Mn across 15 deals last week, marking a 60% decline from the $231.7 Mn raised in the previous week. Battery Smart and Snabbit topped the list, raising $29 Mn and $19 Mn, respectively.

EaseMyTrip Back In The Black: The listed travel tech major reported a net profit of INR 13.9 Cr in Q4 FY25 against a loss of INR 15.1 Cr in the year-ago quarter. However, operating revenue declined 15% YoY to INR 139.5 Cr in the quarter under review.

BNP Paribas Picks Up Stake In Zomato: The French banking giant has bought 6.24 Lakh shares of the foodtech major at INR 238.25 apiece, translating into a total of INR 1,488 Cr. BNP Paribas also offloaded 2.48 Lakh shares of Nykaa worth INR 503.61 Cr.

India’s Indigenous LLM Push: After SarvamAI, the IT ministry has now selected Soket AI Labs, Gnani.ai and Gan.ai to build large language models under the IndiaAI mission. The startups were selected from a pool of 506 applications received by the ministry till April 30.

Startup IPO Tracker 2025: Twenty-three startups are in various stages of their IPO preparations this year. Of these, eleven have already filed their draft IPO papers. Check out which startups are making a beeline for the Indian bourses.

Inc42’s Layoff Tracker 2025: Amid a wave of organisational restructuring and the widespread adoption of AI, Indian startups have axed more than 3,600 jobs in 2025 so far. Read on to know which startups have undertaken mass layoffs this year.

Inc42 Startup Spotlight

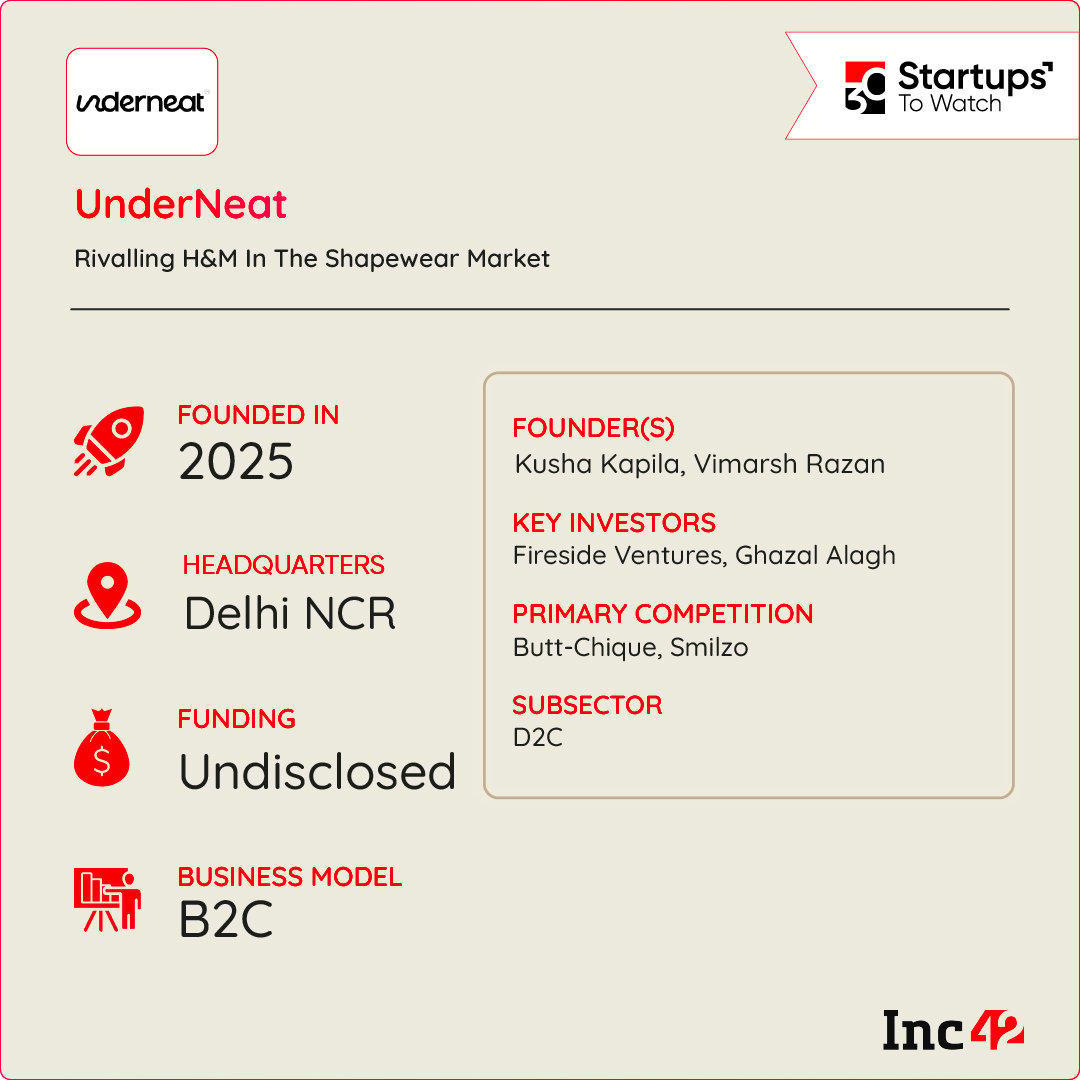

Can UnderNeat Take On H&M & Zivame In India’s Shapewear Market?

Dismayed by the lack of affordable yet stylish shapewear options, particularly for younger consumers, in the Indian market, influencer Kusha Kapila partnered with Vimarsh Razdan to launch UnderNeat in 2025.

Inspired By Global Peers: Drawing inspiration from the global success of Kim Kardashian’s shapewear brand SKIMS, the D2C brand offers a range of products, including bodysuits, shorts and other accessories like body tapes to nurture confidence in their customers.

The brand’s distribution strategy revolves around leveraging Kapila’s significant online presence and personal brand to drive sales. By pricing its products 30-40% lower than SKIMS, UnderNeat aims to capture a significant share of the emerging shapewear category in India.

As India’s shapewear market races towards $131.2 Mn by 2028, can UnderNeat make room for itself in a space long dominated by H&M, Zivame, and Clovia?

The post Razorpay’s Taxing Flip, New-Age Tech Stocks Fumble & More appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media