[[{“value”:”

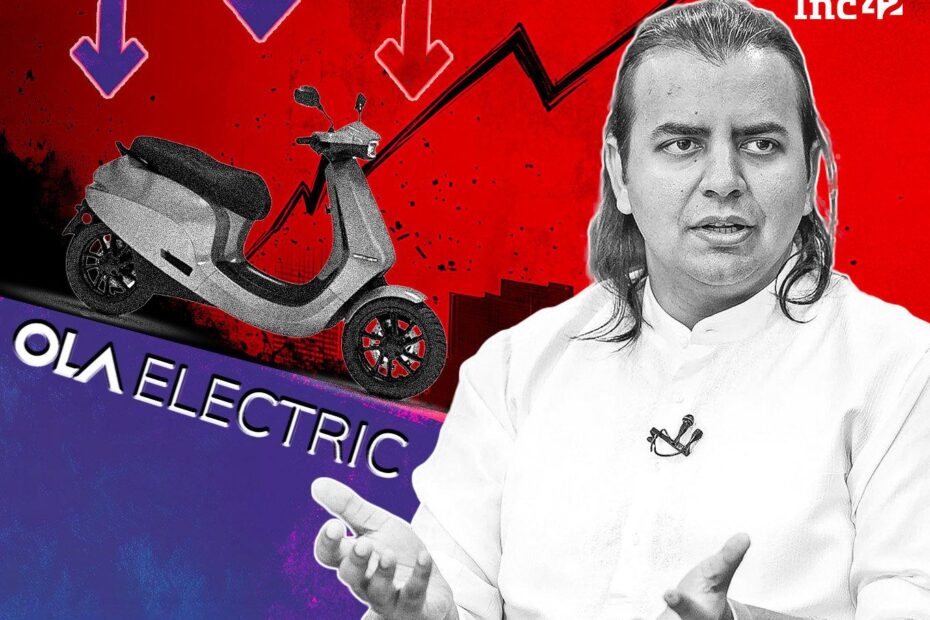

Ola Electric founder and chief executive Bhavish Aggarwal has reportedly paid around INR 20 Cr ($2.3 Mn) in cash to top up collateral for borrowings against shares on back of a sustained decline in share price.

Aggarwal had raised INR 250 Cr for his third unicorn and AI platform Krutrim by pledging Ola Electric shares in December. A few months later, he pledged an additional 5.88 Cr shares of the EV major to raise more debt for Krutrim.

Aggarwal has been putting in extra money since March as the shares dipped below INR 50 apiece, a Bloomberg report said. However, the value of the stock’s collateral is more than twice the borrowed amount and no margin calls were triggered, sources told the news agency.

If the value of the pledged shares falls below the amount fixed with the lender in the agreement, it triggers a margin call. In such a scenario, to make up for the shortfall in collateral, the promoters need to provide additional shares to the lender or pay cash.

Aggarwal has pledged or encumbered about 8% of his 30% stake in Ola Electric, the report said. Avendus Group, InCred Alternative Investments and Modulus Alternatives Investment Managers had lent him the money against bonds issued by Krutrim, carrying coupon rates of 14.9% to 15.9%, and backed by Ola Electric shares, Bloomberg reported.

The INR 20 Cr infusion in collateral comes close on the heels of Hyundai Motor and Kia Corporation selling more than 13.6 Cr shares in Ola Electric in multiple bulk deals of INR 689.31 Cr.

From the shares flooding the market, Citi Group Global Markets Mauritius lapped up 8.61 Cr at INR 50.55 each for a sum of INR 435.7 Cr.

Inc42 has reached out to Aggarwal for comments on the development. The story will be updated on receiving his response.

Ola Electric Stock Skids 35% Since Listing

The stock of Ola Electric has plunged 35% from the listing price of INR 76. The stock closed down nearly 1.8% at INR 49.06 on the BSE on June 5, sending its market capitalisation to INR 21,639.53 Cr with more than 3.30 Cr shares changing hands. The stock hit its all-time low at INR 45.55 on the BSE on April 7.

As the share price kept on sliding, Aggarwal pre-funded 3-4 months of accrued interest, instead of topping up the collateral with more shares, sources told Bloomberg.

Ola Electric debuted in the stock market with a flat listing last August. The shares were listed on the BSE at INR 75.99 apiece as against its IPO issue price of INR 76. On the NSE, the shares opened flat at INR 76 apiece.

On the financial front, Ola Electric’s consolidated net loss deepened 109% to INR 870 Cr in Q4 FY25 from INR 416 Cr a year ago, and 54% sequentially from INR 564 Cr. Its operating revenue crashed 62% to INR 611 Cr from INR 1,598 Cr last year and 42% from INR 1,045 Cr last quarter. A one-time warranty provision of INR 250 Cr too contributed to the hefty losses.

A day after the company disclosed its financials for the fourth quarter, the stock crashed 10% to INR 48.07 intraday on May 30.

The post Bhavish Aggarwal Tops Up Collateral With INR 20 Cr As Ola Electric Stock Skids appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media