[[{“value”:”

BigBasket Joins The Quick Bite Race

Tata-backed BigBasket is all set to become the latest startup to launch its 10-minute food delivery service across India. The quick commerce company is piloting a new service in Bengaluru and plans to expand it to 40 dark stores by July 2025. They aim to launch this service nationwide by the end of FY26.

Banking On The Tata Name: Instead of partnering with restaurants, BigBasket plans to build a vertically integrated model that uses its own dark store infrastructure and curated food line-up. What also makes the company’s offering unique is that BigBasket will deliver ready-to-eat snacks and beverages exclusively from Tata-owned brands like Starbucks and Qmin.

In A Turbulent Market: BigBasket’s entry into the quick food delivery market comes as rivals continue to grapple with challenges related to scale, sustainability and consumer retention. While Zepto has pulled back from several tier II and III cities, despite hitting 1 Lakh daily orders in February 2025, Eternal has shut down both ‘Instant’ and ‘Quick’ due to low incremental demand.

What differentiates BigBasket is its in-house brands, which eliminate third-party restaurant costs and allow for competitive pricing. This model also ensures consistent quality and reliable delivery, unlike aggregators dealing with numerous external restaurants.

Eye On The IPO: The new experiment comes at a time when the Tata-owned brand is gearing up for a public listing within the next 18–24 months. Fuelling this ambition is its quick commerce momentum and deeper integration with the broader Tata digital ecosystem.

Nevertheless, with 700 dark stores already in place and plans for 1,200 by the end of 2025, BigBasket’s infrastructure looks solid on paper. But, with rivals consolidating or folding their quick food bets, the question is — can BigBasket scale 10-minute food deliveries without burning out?

From The Editor’s Desk

Meesho Inches Closer To IPO: The ecommerce major converted into a public entity after the company‘s board passed a resolution to drop “Private” from its name. The SoftBank-backed unicorn has already picked bankers for its $1 Bn IPO, slated for 2025-end.

Fire Sale At BYJU’S: The edtech’s two US-based entities – Tynker and Epic! – have been sold off by its lenders. While Tynker was acquired by CodeHS for $2.2 Mn (down 99% from 2021), Epic! was snapped up by TAL Education Group at a steep discount of 81% for $95 Mn.

India’s Sovereign AI Dreams: While the emerging technology has grabbed the attention of regulators, India finds itself at a crossroads as the government looks to walk a tightrope between innovation and regulation. Here’s what is cooking in the corridors of power on the AI front?

Wow! Momo Picks Up Debt: The Kolkata-based QSR chain has raised INR 85 Cr in debt from Stride Ventures. This follows reports that the company was looking to raise INR 150 Cr in a round led by Haldiram’s promoter and Malaysia’s wealth fund Khazanah Nasional.

WLDD Acquires Imagined Studio: Wubba Lubba Dub Dub has purchased the creative marketing startup in an all-cash deal to bolster its AI and design capabilities. Imagined offers 3D design, motion graphics and ad creation services, among others, to enterprises.

GIVA To Raise INR 450 Cr: The board of the D2C jewellery brand has passed a resolution to issue 1.73 Lakh CCPS at INR 25,947 apiece to raise the capital in a round led by Creaegis. With this, the startup’s valuation jumped a hefty 47% to $374 Mn from $254 Mn last year.

ChatGPT Goes Offline: The OpenAI chatbot faced a massive outage as thousands of users globally were unable to use the service for more than eight hours on June 10. More than 4,000 users in India also reported that they faced issues while using the GenAI chatbot.

Infibeam’s INR 700 Cr Rights Issue: The payments solution company has filed a draft letter of offer to raise INR 700 Cr via a rights issue. The proceeds from the fundraise will be utilised to pursue acquisitions and bolster its AI play.

Inc42 Startup Spotlight

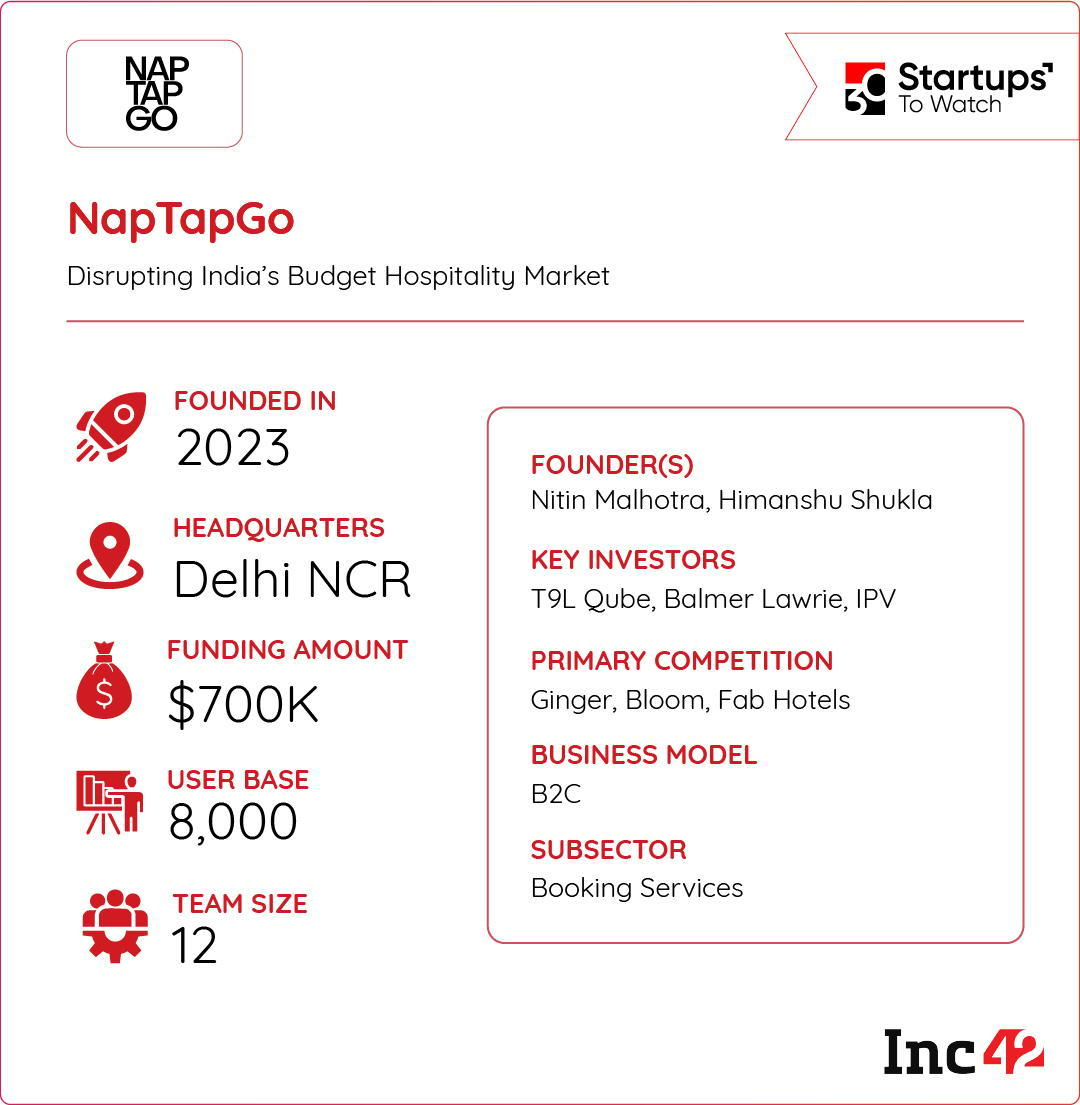

Can NapTapGo Make Pod Hotels Mainstream In India?

India’s fast-growing travel and gig economy has created a strong need for affordable, hygienic, and flexible accommodation, especially in cities and transit hubs. Yet, the market still lacks privacy-focussed, high-density lodging at scale. Budget travellers, students, solo professionals and pilgrims often struggle to find clean and convenient options within reach.

Making The Transit A Cakewalk: Founded in 2023 by Nitin Malhotra and Himanshu Shukla, NapTapGo is introducing capsule hotels to India — inspired by Japan’s pod hotels. Their compact properties, offering 30 beds in just 300 sq m, demonstrate that low-capex, high-repeat pod stays can work in India.

Not Pricey, But Affordable: NapTapGo’s pricing starts at just INR 500, with an emphasis on privacy, hygiene, and ease of booking. Currently operational in Noida and Amritsar, the startup boasts a customer repeat rate of 35%. It aims to expand its footprint to Mumbai, Gurugram, Udaipur and Varanasi by the end of this year.

With the ambition to carve out a niche in India’s hospitality sector with a new format built for scale, can NapTapGo win the low-cost hospitality market dominated by OYO?

The post BigBasket’s Meal Express, Meesho’s IPO & More appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media