[[{“value”:”

Geopolitics is evolving, and it is evolving fast, unpredictably and more ruthlessly than ever. However, this time the global power play is not about oil. It is over something rarer than fossil fuels — critical minerals.

When Donald Trump took the oath as the president of the United States on January 20, 2025, everyone knew it was going to be a bumpy ride ahead. And, that is exactly what followed with his aggressive reciprocal tariff move.

Under this regime, Trump announced steep reciprocal tariffs ranging from 10% to 50% on 24 nations, slapping a 34% tariff on Chinese imports in response to Beijing’s existing 76% duties on American goods.

China didn’t take very long to respond. On April 4, just two days after Trump’s announcement, it dropped a geopolitical bombshell, banning the export of seven critical rare earth elements — samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium.

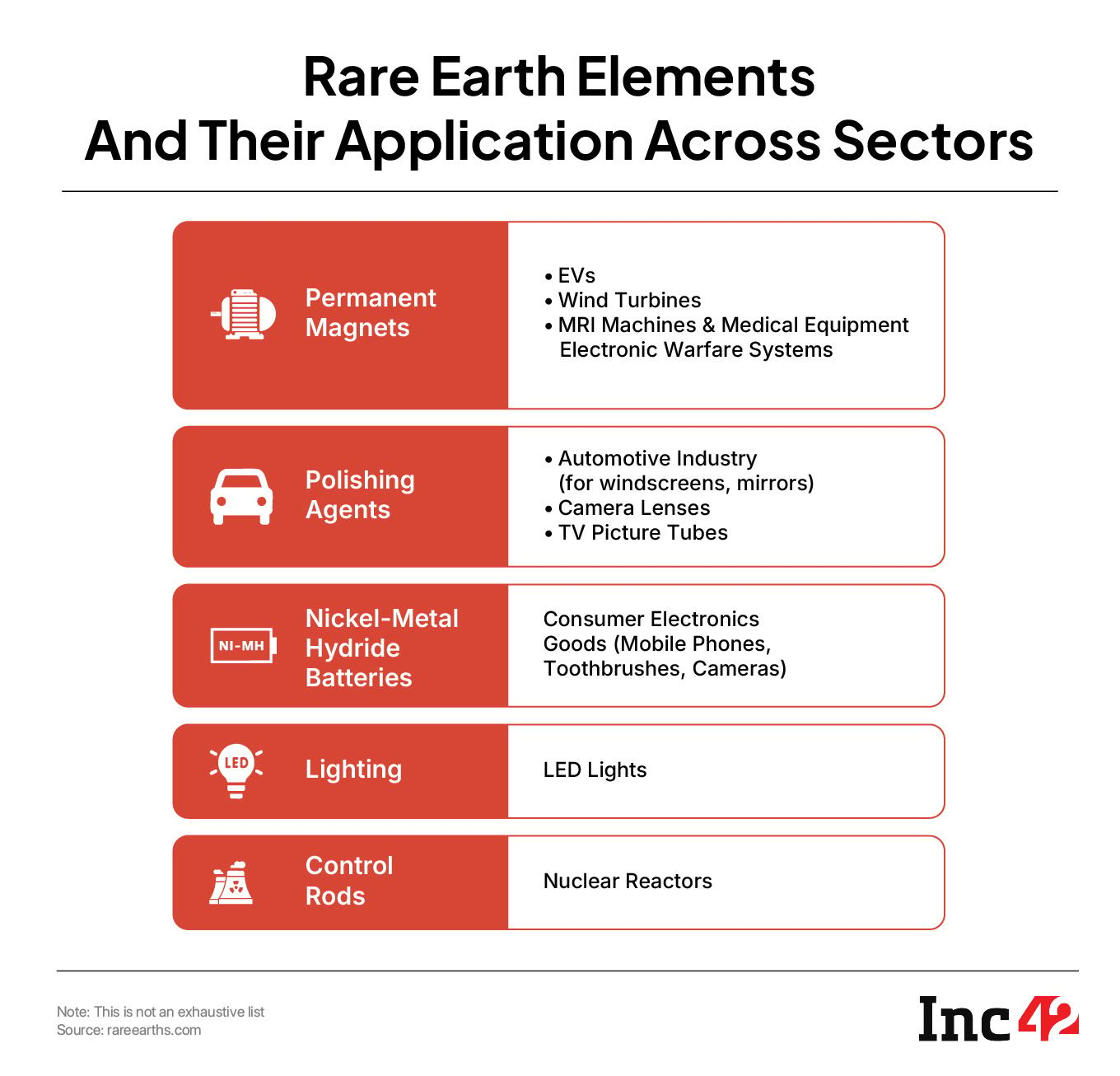

These elements are crucial for producing rare earth magnets that have their applications in everything from smartphones and fighter jets to electric vehicles and wind turbines.

As anyone would have predicted, the impact was prompt. Markets trembled as many tech, defence and manufacturing companies whiteknuckled, fearing the worst — a pandemic deja vu when the world had to endure semiconductor shortages, as supply chains from China remained disrupted due to lockdowns.

As far as China is concerned, a swift answer by the East Asian nation is a reminder to the world that when it comes to critical minerals, it holds the dominance and will not hesitate to play hardball if need be.

Amid this tug-of-war, the Indian automobile sector seems to be on the receiving end. Ironically, industry leaders look unaffected. Now, before we get into unravelling what is fuelling their confidence, let’s steal a glance at the government’s stance on the situation.

Govt Preaches Self-Reliance

Just like the pandemic, when global production lines came to a grinding halt due to the disruption in semiconductor supplies from China, India now finds itself at a similar crossroads. However, this time, it’s rare earth magnets.

Many Indian automotive majors, including TVS Motor and Bajaj Auto, have already flagged possible production delays. Maruti Suzuki India is also recalibrating production of its upcoming model e-VITARA due to the shortage of rare earth magnets.

According to industry experts, China is deliberately choking the supply chain of India’s automotive industry and other booming electronics manufacturing ecosystems.

Amid the chaos and confusion, commerce and industry minister Piyush Goyal recently met some of India’s top automotive players and component manufacturers in Delhi.

These players expressed their concerns over low inventories if the situation persists and urged the Centre to intervene. However, the minister preached self-reliance, according to a source close to the development. Goyal wants Indian companies to develop tech to curb reliance on China, precisely what he pitched to the world during his official visit to Switzerland last week.

“This situation serves as a wake-up call for all those who have become over-reliant on certain geographies. It’s a wake-up call for the whole world that you need trusted partners in your supply chain,” he added.

Goyal’s statements have intrigued us. However, how easy or difficult is it for India to break the shackles of China’s imports? And, is the theory of self-reliance just another catchphrase from the fictional book of a picture-perfect India?

Let’s Understand Where India Stands

Globally, India has the fifth-largest reserve of rare earth elements. Despite this, India ranks nowhere when it comes to satiating its industrial appetite.

The state of exports is even more miserable. The country exported scandium and yttrium worth a mere $24.45K to the UAE, the US, Bhutan and Peru in 2023. Notably, scandium is primarily used in aerospace and sports equipment, while yttrium is found in electronics, medical imaging, and superconductors.

Moving on, even though India has some rare earth reserves in Rajasthan, Kerala, Tamil Nadu, West Bengal, Odisha, Andhra Pradesh, Maharashtra, and Gujarat, their mining is tricky — either due to the geological sensitivity of these areas or these elements are just in the initial phases of exploration.

Many rare earth elements have radioactive properties, which make them difficult to mine and refine.

As per a 2023 report, even though India has developed facilities to mine, separate and refine rare earth elements rare earth, the country lacks the tech, industrial-scale facilities, and a robust supply chain of many other crucial materials for developing rare earth alloys and magnets.

However, China, with a huge base of REE resources, has commanded its monopoly over rare earth elements since the 1980s.

China currently accounts for 70% of the world’s mined production of rare earth elements and about 90% refined production.

Now, even though India imported a mere 870 tonnes of rare earth magnets, valued at INR 306 Cr, in FY25, China’s export ban has failed to scare automotive players.

Industry Undeterred Despite Short-Term Concerns

Interestingly, after speaking with industry players, Inc42 found that while the electric vehicle industry is undoubtedly facing short- to medium-term challenges, the extent of the impact remains uncertain. Most view it as a temporary setback.

Bajaj Auto has warned that if the ban is not removed soon, the Indian EV two-wheeler market may see its production numbers sink in the short term. TVS, too, has warned of a similar short to medium-term impact.

Uday Narang, the chairman of Omega Seiki Mobility (which manufactures EV three-wheelers), sees minor supply chain disruptions in the near term, which may increase the cost of vehicles.

“While it may be a concern for many OEMs, others who have stockpiled enough material to weather the storm could escape the pinch.”

Deb Mukherji, an automotive veteran and advisor at Anglian Omega Group, too, is of the opinion that serious OEMs keep at least 3-6 months of inventory for such uncertainties.

“And, I don’t see the situation lasting beyond that,” Mukherji said, adding that if China’s ban persists, it won’t be just EVs but the entire automotive industry that would be in deep waters because rare earth elements have more application for OEMs than one can imaging — speedometers, glass, paints and catalytic converters, etc.

But that is too extreme an imagination.

An investor, requesting anonymity, said: If the ban continues for long, smuggling and black marketing of these elements will start, and no government will want to risk its share of taxes just because it is too stubborn to work in harmony with others.

“Given that China is a mercantile economy, why would it stop something that sells like hot cakes? China’s rare earth ban is all bark and no bite.”

Meanwhile, Arpit Agarwal, partner at Blume Ventures, said, “All this hue and cry about supply chain disruptions and commerce getting impacted is eventually only about economics. The prices of procuring these elements will perhaps increase, impacting the prices of the motors and eventually vehicles.”

While the quantum of the impact will be visible only with time and in the Q1 and Q2 FY26 earnings of the automotive players, every industry expert unanimously agrees that this situation is a great opportunity for India to rethink its import dependence on China.

Rare Earth Excavation Is Not A Long-Term Solution

So, why can’t India expedite the mining of its rare earth? Well, it is not sustainable, especially when India is looking at going carbon-emission-free by 2070.

Mining of rare earth elements comes at a great environmental cost. As per a study, every tonne of rare earth mined involves 13kg of dust, 9,600-12,000 cubic metres of waste gas, 75 cubic metres of wastewater, and one ton of radioactive residue.

So, finding alternatives should be the only way forward.

“It’s time to find alternatives and come up with technology that is rare earth-free,” Arpit Agarwal, partner at Blume Ventures, said.

Recently, Ola Electric’s Bhavish Aggarwal announced that the company was building a rare-earth-free motor. The company is planning to introduce it by the end of 2025.

Bengaluru-based Chara Technologies is another example. It has already developed a rare-earth-free motor, and it is already supplying it to some Indian and European customers.

Chara claims that its synchronous reluctance motors are more efficient than the ones that operate on rare earth magnets. However, weight is still a challenge, as the rare earth alloy is much lighter than other alloys.

“REEs are difficult to mine and extract, both economically and environmentally. Besides, control over the supply chain of any material calls for swift action. If more people do not find an alternative and this global supply chain disruption continues, it will be a line stop in India,” said Bhaktha Keshavachar, the founder and CEO of Chara.

As per industry experts, the government and OEMs should be laser-focussed on one thing — developing technologies in parley with IITs and DRDO to give China the taste of its own medicine.

It’s time to turn the tables on China — where India has but one thing to offer, a cold shoulder. However, for now, India’s dream to become self-reliant in the game of unearthing essential minerals only seems rare.

The post Have India’s EV Dreams Hit A Rare Earth Wall? appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media