[[{“value”:”

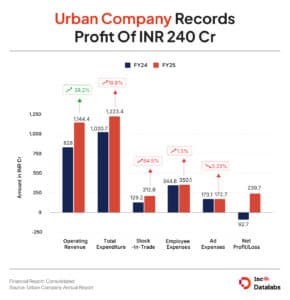

Urban Company turned profitable in the financial year ended March 31, 2025 (FY25). The hyperlocal services startup reported a net profit of INR 239.7 Cr during the fiscal year under review as against a loss of INR 92.7 Cr in FY24.

The startup’s operating revenue jumped 38.2% to INR 1,144.4 Cr in FY25 from INR 828 Cr in the previous fiscal year.

Founded in 2014 by Abhiraj Singh Bahl, Raghav Chandra and Varun Khaitan, Urban Company provides a tech-enabled, full-stack online marketplace platform that enables users to hire professionals for household services such as home cleaning, appliance salon and massage, repair services and painting, among others.

The startup counts Ratan Tata, Accel Partners, Tiger Global, Prosus and Steadview Capital among its backers, and has raised close to $700 Mn since its inception.

The Gurugram-based company also filed its draft red herring prospectus (DRHP) for INR 1,900 Cr public issue in April.

Urban Company primarily generates revenue through platform services, the sale of products to service professionals and the sale of water purifiers and electronic door locks launched under the brand name, Native.

From the sale of products, the company earned a revenue of INR 304.2 Cr in the year under review, while it made INR 840.1 Cr from the sale of services during the same period. Including other income, Urban Company’s total revenue stood at INR 1,260.6 Cr for the year 2024-25.

Further, the startup also has operations overseas, with branches in UAE, Saudi Arabia and Singapore.

The international businesses cumulatively recorded a revenue of INR 147 Cr, constituting 12.8% of the total revenue during the reported period.

Decoding Urban Company’s Expenses

The customer services platform’s expenses zoomed 19.8% to INR 1,223.4 Cr in FY25 from INR 1,020.7 Cr in the previous fiscal year. The other expenses constituted 50.10% of the total expenses, reaching INR 613.2 Cr, in the year under review.

Employee Benefit Expenses: Employee costs, which include salaries, provident fund, gratuity, among others, rose marginally by 1.5% to INR 350.1 Cr from INR 344.8 Cr in FY24. Further, it accounted for 28.6% of the overall expenses in FY25.

Purchase Of Stock-In-Trade: The spending under this head comprises inventory costs, which surged 17.40% to INR 212.6 Cr in FY25 from INR 129.2 Cr in the previous financial year.

Advertising Promotional Expenses: The startup spent INR 172.7 Cr on promotion and advertisements in the fiscal year under review, a 0.23% fall from INR 173.1 Cr in FY24.

In the run up to its public listing, Urban Company board approved to raise INR 528 Cr (about $60 Mn) via a fresh issue in its IPO in April, which will also comprise an undisclosed amount of offer-for-sale component.

As per its DRHP, the unicorn plans to utilise INR 190 Cr of the fresh proceeds towards technology development and cloud infrastructure. It will also deploy INR 70 Cr for lease payments for its office and INR 80 Cr for marketing activities.

Following which, the startup’s founders sold shares worth INR 779 Cr in secondary deals between September 2024 and February 2025. They will not be participating in the OFS round.

The post Urban Company Turns Profitable, Posts INR 240 Cr PAT In FY25 appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media