[[{“value”:”

After soaring last week, the Indian equity market saw consolidation this week. As the bulls took rest, shares of the new-age tech companies under Inc42’s coverage witnessed a mixed week, with stock-specific action.

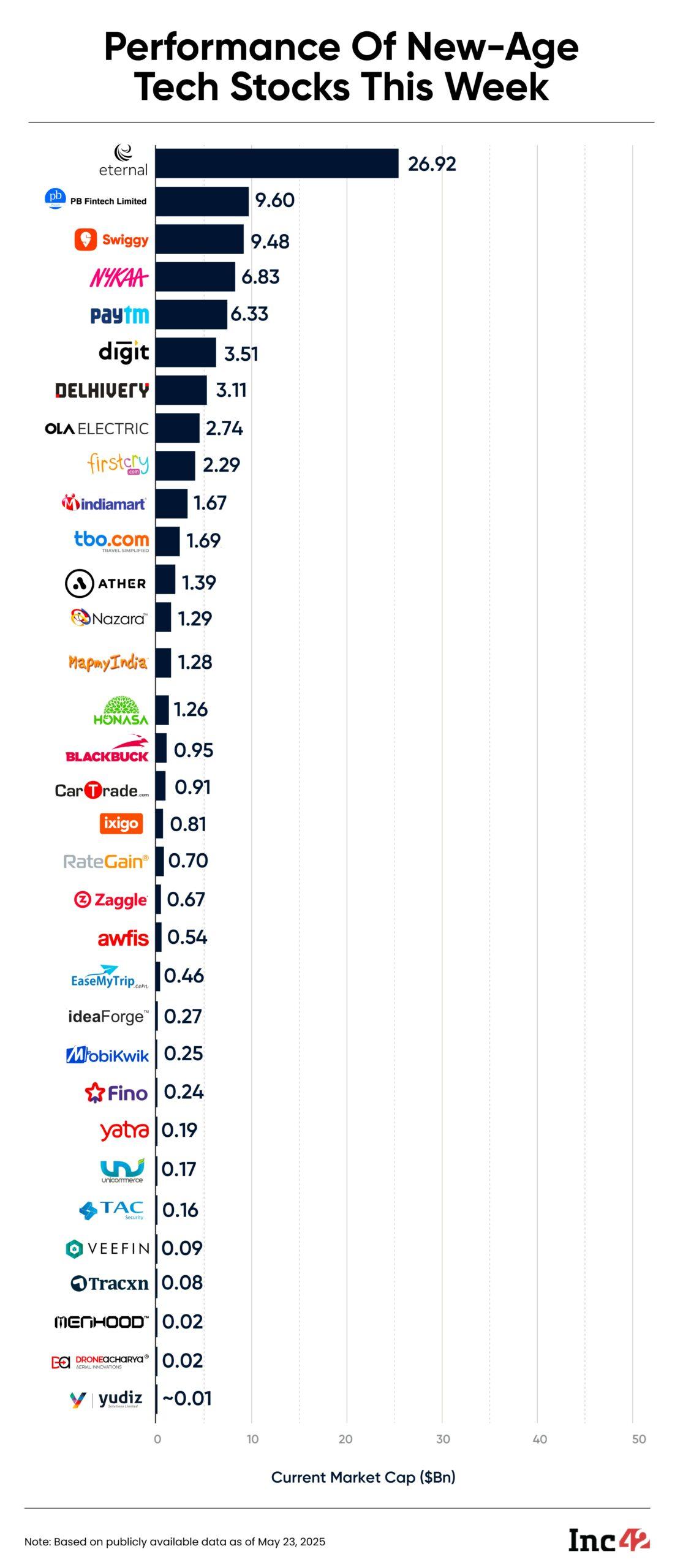

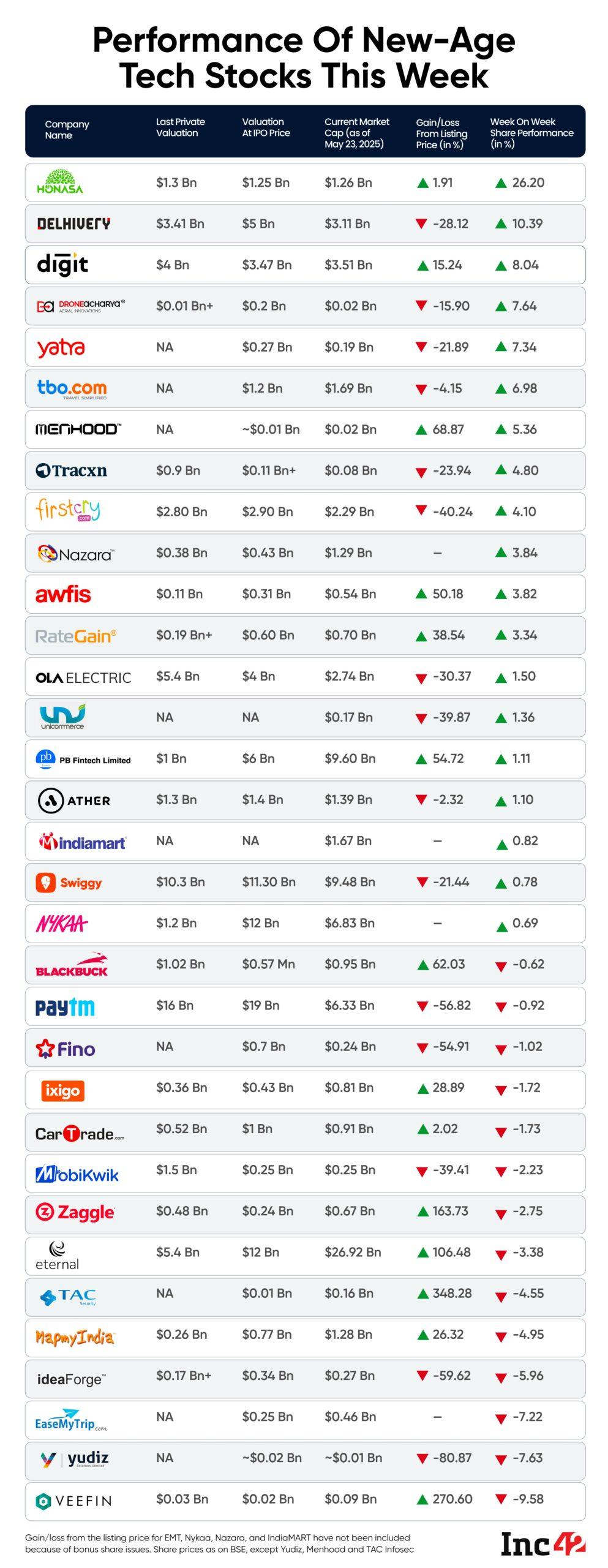

While 19 of the 33 new-age tech stocks gained in a range of 0.69% to over 26%, share prices of 14 companies declined in a range of 0.62% to close to 10%.

Shares of Mamaearth parent Honasa Consumer, which reported a second consecutive profitable quarter in the form of Q4 FY25 this week, emerged as the biggest winner. The stock surged 26.2% to end the week at INR 330.20.

Similarly, logistics major Delhivery, which declared its Q4 numbers after market hours on May 16, gained 10.39% to end the week at INR 354.35 and emerged as the second biggest gainer.

Go Digit was the third biggest gainer this week, with its shares jumping 8.05% to end at INR 323.95.

In the list of gainers, TBO Tek soared 6.98% to end the week at INR 1,322.75.

The travel tech company, on Thursday (May 22), reported a 27% uptick in its net profit to INR 58.9 Cr from INR 46.4 Cr in the year-ago period. Operating revenue zoomed 21% YoY to INR 446.1 Cr. The company’s shares zoomed over 10% on Friday (May 23).

Meanwhile, gaming major Nazara Technologies continued its rally, gaining 3.84% to end the week at INR 1,307.15. The stock touched a fresh 52-week high of INR 1,325 on Thursday. The company’s shares have rallied about 30% year to date and 112.7% from the same day last year.

Continuing its acquisition spree, Nazara announced the acquisition of UK-based Curve Games for INR 248 Cr this week. It said that Curve’s publishing capabilities in the PC and console space and its diverse portfolio will accelerate its global ambitions.

Other gainers this week included Ola Electric, Ather Energy, Swiggy, among others.

Meanwhile, BSE SME-listed company Veefin Solutions emerged as the biggest loser this week, ending its two-week bull run. Its shares declined 9.58% to end at INR 318.90.

EaseMyTrip plunged 7.22% this week to end at INR 11.05. The stock came under selling pressure after it was reported that the Enforcement Directorate (ED) has extended its investigation into the company’s cofounder Nishant Pitti’s alleged links with the Mahadev betting app case. However, EaseMyTrip denied the allegations yet again, labelling them as “entirely baseless, misleading, and devoid of factual merit”.

MobiKwik reported yet another loss-making quarter this week, posting a net loss of INR 56.03 Cr in Q4 FY25 as against a loss of INR 67.1 Lakh in the year-ago period. Consequently, the company’s shares dipped 2.23% to end at INR 267.95. The stock is currently about 40% below its listing price.

Eternal, ideaForge, Zaggle, TAC Infosec, CarTrade were among the other losers this week.

Overall, the total market capitalisation of the 33 new-age tech companies stood at $85.93 Bn at the end of the week as against $86.22 Bn at the end of the previous week.

Global Uncertainties Keep Investors On The Edge

After last week’s bull run, investors turned cautious this week. Sensex and Nifty 50 dipped 0.7% each to end the week at 81,721.08 and 24,853.15, respectively.

As per analysts, the US government’s directive to American companies to halt the use of China-made AI chips raised fears of escalation in tensions between the two countries, denting investor confidence. The delay in finalisation of the US-India trade agreement further added to the uncertainty.

Besides, the turbulence in the global bond markets also impacted the market. Vinod Nair, head of research at Geojit, said that weak US bond auctions and rising treasury yields sparked a global risk-off sentiment, triggering sharp mid-week selloff in the Indian equity market.

“Surging yields in both the US and Japan have raised investor concerns about a potential exodus of FIIs from emerging markets to safer assets,” he noted.

Foreign institutional investors (FIIs) turned sellers this week, withdrawing INR 11,591 Cr from the Indian market.

However, Nair said that the Indian equity market showed resilience, with domestic institutional investors (DIIs) and retail participants turning buyers. This, he said, reflects the confidence in India’s long-term growth prospects.

“While short-term uncertainties may persist due to global political developments, the long-term outlook for FPI flows into India remains positive—especially if corporate earnings align with current market valuations, enhancing investor confidence and justifying sustained capital inflows,” said Saurabh Patwa, head of research and portfolio manager at Quest Investment Advisors.

Now, let’s take a detailed look at the performance of Delhivery and Honasa this week.

Investors Cheer Honasa’s Q4 Numbers

Shares of Honasa hit the 20% upper circuit on Friday (May 23), a day after it reported its Q4 numbers. The company reported a 18% YoY decline in its net profit to INR 25 Cr, while operating revenue rose 13.3% YoY to INR 533.6 Cr in the March quarter.

The results were better than the estimates. As per JM Financial, Honasa’s revenue growth was 5% ahead of estimates.

The brokerage said that better-than-expected performance of core as well as newer brands, higher gross margin and lower staff costs resulted in better-than-expected margin delivery. JM Financial gave the company a ‘Buy’ rating, with a price target (PT) of INR 300.

Notably, Q4 was the second consecutive profitable quarter for the company after it slipped into the red in Q2 FY25. Honasa said that its transition to the new direct distribution model under ‘Project Neev’ is moving well.

In its investor presentation, the company said it has nearly completed its transition to the new distribution model across India’s top 50 cities.

“On the revenue front, the strategy revamp is starting to show green shoots for Mamaearth, with focus categories (70% of brand sales) clocking double-digit growth in the ecommerce channel. On an overall basis, we believe the deceleration was lower vs. past two quarters,” JM Financial said.

Delhivery Surges After Another Profitable Quarter

Shares of Delhivery zoomed after the company reported a consolidated net profit of INR 72.6 Cr in Q4 FY25 as against a loss of INR 68.5 Cr in the year-ago quarter. With this, Delhivery reported its first profitable fiscal year, posting a net profit of INR 162.1 Cr in FY25 as against a loss of INR 249.2 Cr in FY24.

Consequently, the company’s shares surged and its market cap zoomed to $3.11 Bn at the end of the week from $2.8 Bn at the end of the previous week.

As per brokerage Emkay, Delhivery missed Q4 revenue estimates by 4% and EBITDA estimates by 18%. The company’s operating revenue grew only 6% YoY to INR 2,191.6 Cr and declined 9% QoQ from INR 2,378.3 Cr.

However, Emkay maintained its ‘Buy’ rating for the stock while cutting its PT to INR 380 from INR 400 earlier.

The brokerage said that Delhivery’s B2C segment grew only 3% YoY due to subdued demand and insourcing by Meesho.

Delhivery attributed the lukewarm growth in its B2C vertical Express Parcel shipments in FY25 to a decline in overall 3PL industry volumes and consumption headwinds.

However, Emkay remains bullish on Delhivery on the back of its acquisition of Ecom Express.

“The management is hopeful of pricing sanity prevailing in the 3PL B2C industry. As such, some pick up is being seen in Q1 FY26 volume owing to this consolidation. With Meesho’s slated goal to continue insourcing, we expect only a gradual recovery in B2C volumes,” Emkay said.

In the company’s post earnings call, CEO and MD Sahil Barua said that Delhivery is the only profitable player in the logistics business, with its competitors seeing a rise in their losses. He said that Delhivery acquired Ecom Express given that its losses were expanding, leading to questions over the business’ sustainability.

“I think what this deal has done is it does signal that if you are a loss-making network in Express Parcel with no path to profitability, consolidation or exit is an inevitable outcome. So, I think we’re very happy. Our position will continue to improve. As you can see from our cost advantages, they are not theoretical, they are material,” he added.

[Edited by: Vinaykumar Rai]

The post Honasa, Delhivery Gain Big Amid A Mixed Week For New-Age Tech Stocks appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media