[[{“value”:”

Cha-Ching! Razorpay Expands Its Fintech Verse

Stepping beyond its core B2B focus and entering the consumer space, Razorpay has now stepped into the UPI realm by acquiring a majority stake in digital payments startup POP for $30 Mn.

POP allows users to make UPI payments and earn POPCoins in return. These coins can then be redeemed to make purchases on its integrated marketplace and other D2C platforms.

What’s In It For Razorpay? The deal will enable Razorpay to diversify its product mix and create alternate streams of revenue. Then, there is the added benefit of leveraging POP’s existing 6 Lakh daily UPI transactions, 1 Mn monthly active users, and 2 Lakh monthly commerce shipments.

Razorpay’s Full-Stack Pitch: On the B2B front, the move will help the fintech unicorn drive repeat purchases for businesses by combining instant rewards, payments, and brand discovery. Combined with its earlier acquisition of rewards management platform PoshVine, the new deal will pave the way for building a full-stack intelligent marketing growth suite under Razorpay Engage.

Eye On The IPO Prize: As it heads down the IPO route, the latest feather in its cap could give it a major revenue boost. On top of this, what makes the fintech unicorn a jaw-dropping proposition is its FY24 profits, which exploded 365% YoY to INR 33.5 Cr, although operating revenues saw a humble 9% YoY increase to INR 2,475 Cr.

More importantly, the company is all suited up for its public listing. Not only has the fintech major concluded its Desh Wapsi but also turned into a public entity earlier this year, addressing two of the crucial aspects of D-Street listing. However, it is staring at a ‘flip back’ tax liability of over $450 Mn.

With Razorpay entering the UPI-verse, it is now at loggerheads with giants like CRED and Paytm. Let’s find out what’s ‘POP’ping at Razorpay.

From The Editor’s Desk

India’s EV Dreams Hit A Wall: The Indian auto sector seems to be on the receiving end amid China’s curbs on exports of rare earth minerals. Despite potential short-term production setbacks, EV makers believe the disruption is manageable. So, what’s fuelling their confidence?

MakeMyTrip To Dump Chinese Backers? The Nasdaq-listed OTA plans to raise $2 Bn to buy back stake from its Chinese investor Trip.com Group Limited. This follows rival EaseMyTrip founder Nishant Pitti highlighting large Chinese shareholding in MakeMyTrip.

ArisInfra All Set For IPO: The B2B ecommerce company has raised INR 224.8 Cr from anchor investors ahead of its public listing. ArisInfra plans to raise INR 499.6 Cr via its public issue, which consists solely of a fresh issue component.

Quadria’s $300 Mn Fund: Following its split from KIOS, the healthcare-focused PE firm has launched HealthQuad Fund III, with a greenshoe option of $100 Mn. The fund will back 13-15 startups across segments such as healthtech, digital therapeutics, among others.

Delhivery’s Ecom Express Buyout: The CCI has approved the listed logistics giant’s acquisition of a 99.44% stake in Ecom Express for $165 Mn. The acquisition will enable Delhivery to enhance its service quality and expand its network.

New CBO At Mamaearth: The D2C unicorn’s parent Honasa has appointed Yatish Bhargava as its new chief business officer, following the resignation of Zairus Master in January. Bhargava counts 17 years of experience under his belt and has worked at Flipkart and HUL.

Data Breach At Zoomcar: The rental car marketplace has been hit by a cyber attack, which leaked the personal data of its 8.4 Mn users. The cyber attack comes at a time when the startup is grappling with founder exits, legal turmoil and financial distress.

Profitability Over IPO For Zepto: CEO and cofounder Aadit Palicha has said that the quick commerce major postponed its IPO plans to focus more on growth, profitability and domestic ownership. The unicorn is now eyeing up to $1 Bn IPO by 2026.

Inc42 Startup Spotlight

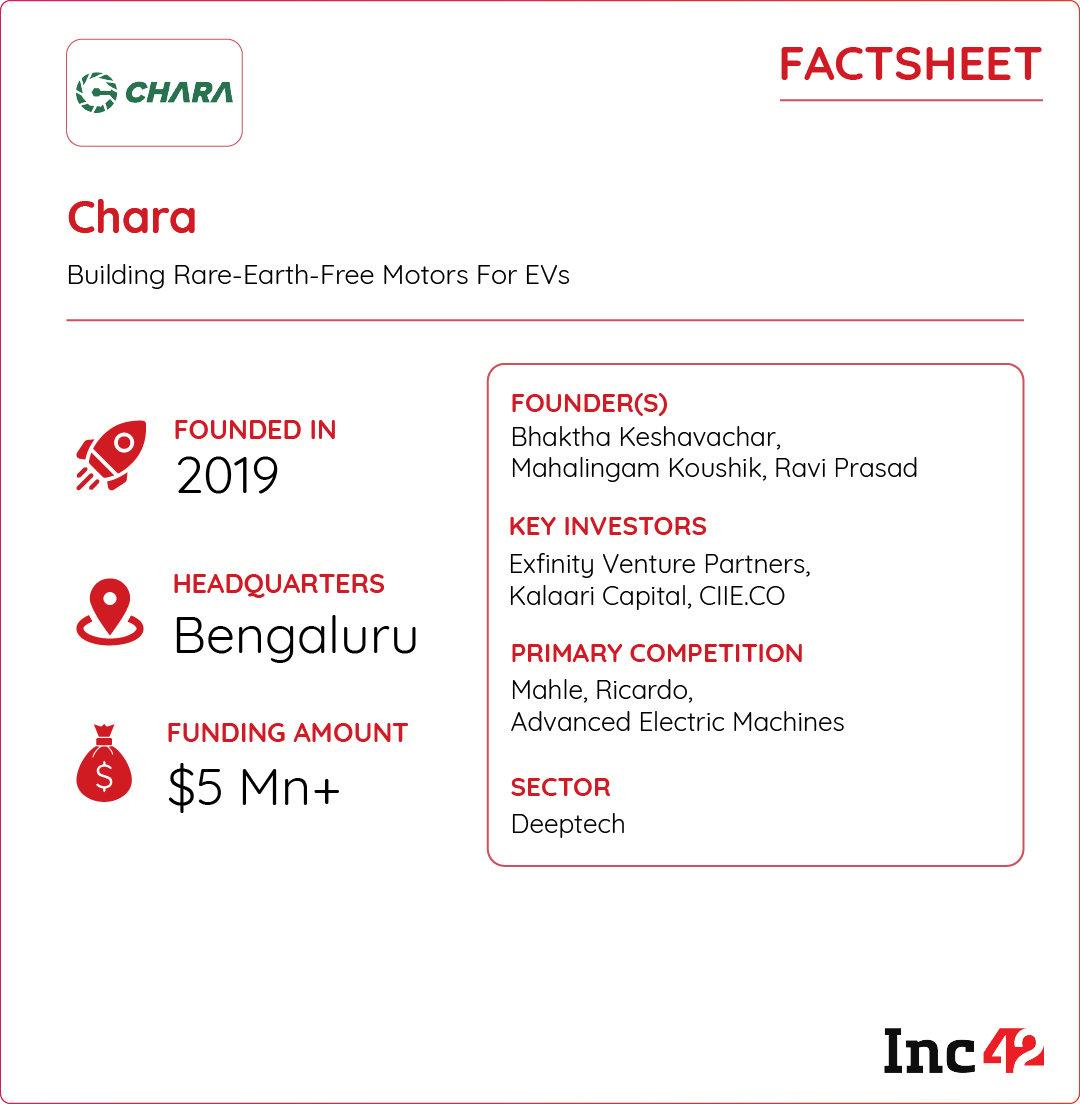

Ditching China’s Rare Earth Grip With Smarter EV Motors

China’s curbs on the exports of rare earth materials are biting Indian EV makers. This is simply because these critical elements are important for everything from paints to permanent magnets used in electric motors. Having predicted this problem a decade ago, Bhaktha Keshavachar, Mahalingam Koushik and Ravi Prasad founded Chara Technologies in 2019.

Making India Self-Reliant: Chara builds rare-earth-free synchronous reluctance motors for EVs and industrial use. The startup claims that its motors use reluctance to generate torque and are 5% more efficient than traditional rare-earth ones.

Raking In The Moolah: Although Chara originally targeted to disrupt the EV market, about 60% of its revenue comes from off-highway applications due to fewer regulatory hurdles. The startup serves 50 customers, including Godrej, Greaves Cotton and Sonalika.

Chara’s Bold Ambitions: Chara’s current manufacturing facility has a capacity of producing 500 motors a month. However, the startup plans to scale this number to 2,000 motors a month by the end of 2025, and is looking to raise INR 50 Cr to INR 60 Cr in Series A round to fuel this vision.

With an eye on selling 15,000 motors and earning $5 Mn in FY26, can Kalaari-backed Chara help Indian EV makers trim reliance on China with its rare-earth-free motors?

The post Razorpay Expands Fintech Verse, India’s EV Dreams Hit A Wall & More appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media