[[{“value”:”

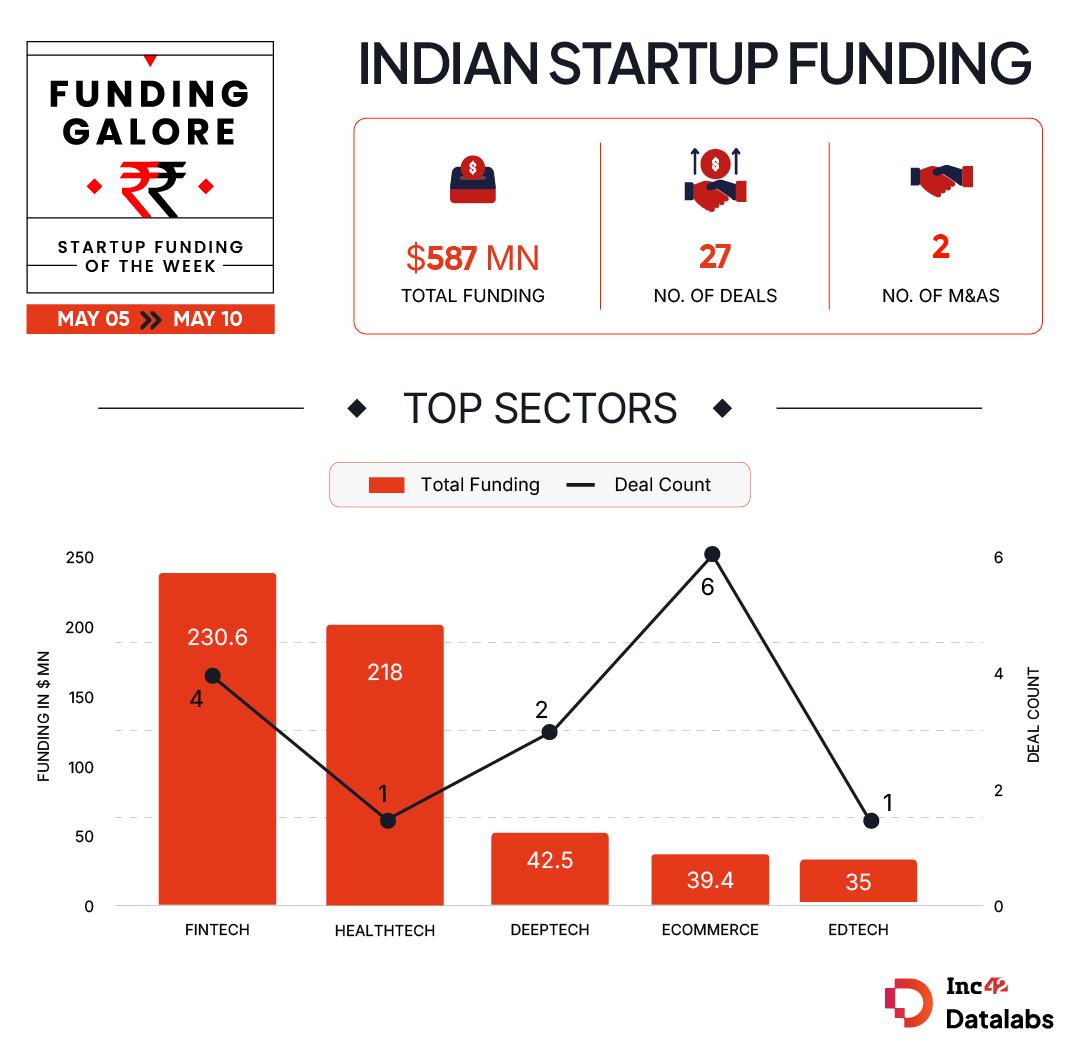

Funding momentum across the Indian startup landscape galloped in the first week of May, thanks to a bunch of small-and late stage deals. Between May 5 and 10, startups raised $587 Mn across 27 deals, marking a 9X jump from the $54.7 Mn bagged by 15 startups in the preceding week.

The week also saw logistics startup Porter scooping up $200 Mn to become the second unicorn of 2025. The Series F fundraise was a mix of primary and secondary deals.

Meanwhile, the week also saw one of the largest seed funding deals materialise in the Indian startup ecosystem in the form of PB Fintech incubated PB Health raking in $218 Mn cheque to expand its hospital network chain.

Let’s take a look at the overall deals struck over the past week.

Funding Galore: Indian Startup Funding Of The Week [ May 5 – 10 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 8 May 2025 | PB Health | Healthtech | Healthcare Services | B2C | $218 Mn | Seed | General Catalyst, PB Fintech | General Catalyst |

| 8 May 2025 | Porter | Logistics | Freight | B2B-B2C | $200 Mn*** | Series F | Kedaara Capital, Wellington Management, Vitruvian Partners | Kedaara Capital, Wellington Management |

| 7 May 2025 | Routematic | Travel Tech | Transport Tech | B2B-B2C | $40 Mn | Series C | Fullerton Carbon Action Fund, Shift4Good | Fullerton Carbon Action Fund, Shift4Good |

| 7 May 2025 | Flipspaces | Real Estate Tech | Real Estate Services | B2B | $35 Mn | – | Iron Pillar, Prudent Investment Managers, Synergy Capital | Iron Pillar |

| 6 May 2025 | Celcius Logistics | Logistics | Supply Chain | B2B | $29.3 Mn | Series B | Eurazeo, Omnivore, IvyCap Ventures, Trifecta Capital, Lighthouse Canton, BlackSoil, UCIC, GetVantage | Eurazeo, Omnivore |

| 6 May 2025 | BharatPe | Fintech | Payments | B2B-B2C | $15 Mn | Debt | Neo Group, Trifecta Capital | Neo Group, Trifecta Capital |

| 6 May 2025 | The Good Bug | Ecommerce | D2C | B2C | $11.8 Mn | Series B | Susquehanna Asia VC, Fireside Ventures | Susquehanna Asia VC |

| 7 May 2025 | Posha | Ecommerce | D2C | B2C | $8 Mn | Series A | Accel, Xeed Ventures, WaterBridge Ventures, Binny Bansal | Accel |

| 7 May 2025 | InspeCity | Deeptech | Spacetech | B2B | $5.6 Mn | Seed | Lucky Investment Managers, Speciale Invest, MGF Kavachh, Shastra VC, Antler India, DeVC India, Anicut Capital | Lucky Investment Managers |

| 5 May 2025 | 91trucks | Ecommerce | B2C Ecommerce | B2C | $5 Mn | – | Arkam Ventures, Titan Capital, Sparrow Capital, India Accelerator | Arkam Ventures |

| 7 May 2025 | Blissclub | Ecommerce | D2C | B2C | $3.9 Mn | Series B | Elevation Capital, Eight Roads Ventures | Elevation Capital |

| 6 May 2025 | Nawgati | Travel Tech | Transport Tech | B2B-B2C | $2.5 Mn | Pre-Series A | Ajay Upadhyaya, Vivek Mathur, Deepak Bhagnani family office, MeitY Startup Hub, Aamara Capital, Sanjay Sharma, Ashish Sharma, Prithvijit Roy | Ajay Upadhyaya |

| 7 May 2025 | Troovy | Ecommerce | D2C | B2C | $2.3 Mn | Pre-Series A | Fireside Ventures, Sharrp Ventures, Spring Marketing Capital, Veltis Capital | Fireside Ventures |

| 7 May 2025 | CodeAnt AI | Enterprise Tech | Horizontal SaaS | B2B | $2 Mn | – | Y Combinator, Uncorrelated Ventures, VitalStage Ventures, DeVC, Transpose Platform, Entrepreneur First | Y Combinator, Uncorrelated Ventures, VitalStage Ventures |

| 5 May 2025 | Volt14 | Cleantech | Electric Vehicles | B2B | $1.9 Mn | Pre-Series A | Blume Ventures, Beyond Next Ventures, Spectrum Impact, Supermorpheus, Cocoon Capital | Blume Ventures |

| 8 May 2025 | Vaya | Consumer Services | – | B2C | $1.5 Mn | Seed | Accel, Arkam Ventures, Weekend Fund, Sumer Juneja, Sarthak Mishra, Rohit Chennamaneni, Legacy Ventures | Accel, Arkam Ventures |

| 8 May 2025 | High Time Foods | Consumer Services | Hyperlocal Delivery | B2C | $1.2 Mn | Seed | Avaana Capital | Avaana Capital |

| 8 May 2025 | Zebu | Deeptech | Dronetech | B2B | $1 Mn | Pre-Series A | Bluehill VC | Bluehill VC |

| 7 May 2025 | Shiplog | Logistics | Ecommerce Logistics | B2B | $761K | Seed | Deepak Bhagnani Family Office | Deepak Bhagnani Family Office |

| 8 May 2025 | Feline Spirits | Alcoholic Beverages | – | B2C | $609K | Pre-Series A | Inflection Point Ventures | Inflection Point Ventures |

| 5 May 2025 | Store My Goods | Logistics | Storage Services | B2B-B2C | $467K* | – | JIIF | JIIF |

| 8 May 2025 | GoTrust | Enterprise Tech | Horizontal SaaS | B2B | $400K | Pre-Seed | Aevitas Capital | Aevitas Capital |

| 5 May 2025 | Lifechart | Ecommerce | D2C | B2C | $360K | Seed | Prajay Advisors, Prakash Mody, Jayendra Shah | Prajay Advisors |

| 6 May 2025 | SaleAssist.ai | Enterprise Tech | Horizontal SaaS | B2B | $300K | – | ASICS Ventures Corporation, India Accelerator | ASICS Ventures Corporation, India Accelerator |

| 6 May 2025 | KorinMi | Consumer Services | Hyperlocal Services | B2C | – | Pre-Seed | Vikas Agarwal, Vivek Kumar | Vikas Agarwal, Vivek Kumar |

| “Source: Inc42 *Part of a larger round **Included this week as it was skipped last week *** Includes both primary and secondary dea Note: Only disclosed funding rounds have been included “ |

||||||||

Key Startup Funding Highlights Of The Week

- Capitalising on Porter’s $200 Mn deal, logistics sector emerged as the flavour of the week for investors. Besides Celcius Logistics, Shiplog and Store My Goods are the other startups operating in the space to secure fresh capital.

- Ecommerce continued to lead the sectoral chart in terms of weekly fundings this week. Six startups in the sector cumulatively raised $31.4 Mn in the first week of May.

- The week also saw a healthy interest from investors across categories. Venture debt firm Trifecta Capital, VC firm Accel, India Accelerator and Deepak Bhagnani Family Office were among the most active investors this week, backing two startups apiece.

- Seed funding spiked to $227.4 Mn this week driven by PB Health’s maiden funding round.

Other Developments Of The Week

- In a bid to boost the Indian startup funding, the Centre doubled the maximum guarantee cover per borrower under Credit Guarantee Scheme for Startups (CGSS) to INR 20 Cr from INR 10 Cr.The scheme aims at improving access to collateral-free debt funding to startups via banks, NBFCs, AIFs and other registered financial entities.

- BrowserStack acquired Y Combinator-backed SaaS company Requestly to bolster its product suite.

- IndiaMART Intermesh completed the buyout SaaS startup Livekeeping Technologies this week, purchasing the remaining 34% stake of the company for INR 26.78 Cr ($3.1 Mn).

- Caught in crisis, BluSmart’s existing investors bp Ventures and responsAbility Investments are looking to pour in $30 Mn to revive its ride-hailing business.

- Gaming major Nazara received NCLT go-ahead to buy insolvency-ridden Smaaash Entertainment.

The post From PB Health To Porter — Indian Startups Raised $587 Mn appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media