[[{“value”:”

The volatility in the funding momentum across the Indian startup ecosystem continued in the final week of May. After gathering steam, investment activity slumped again this week.

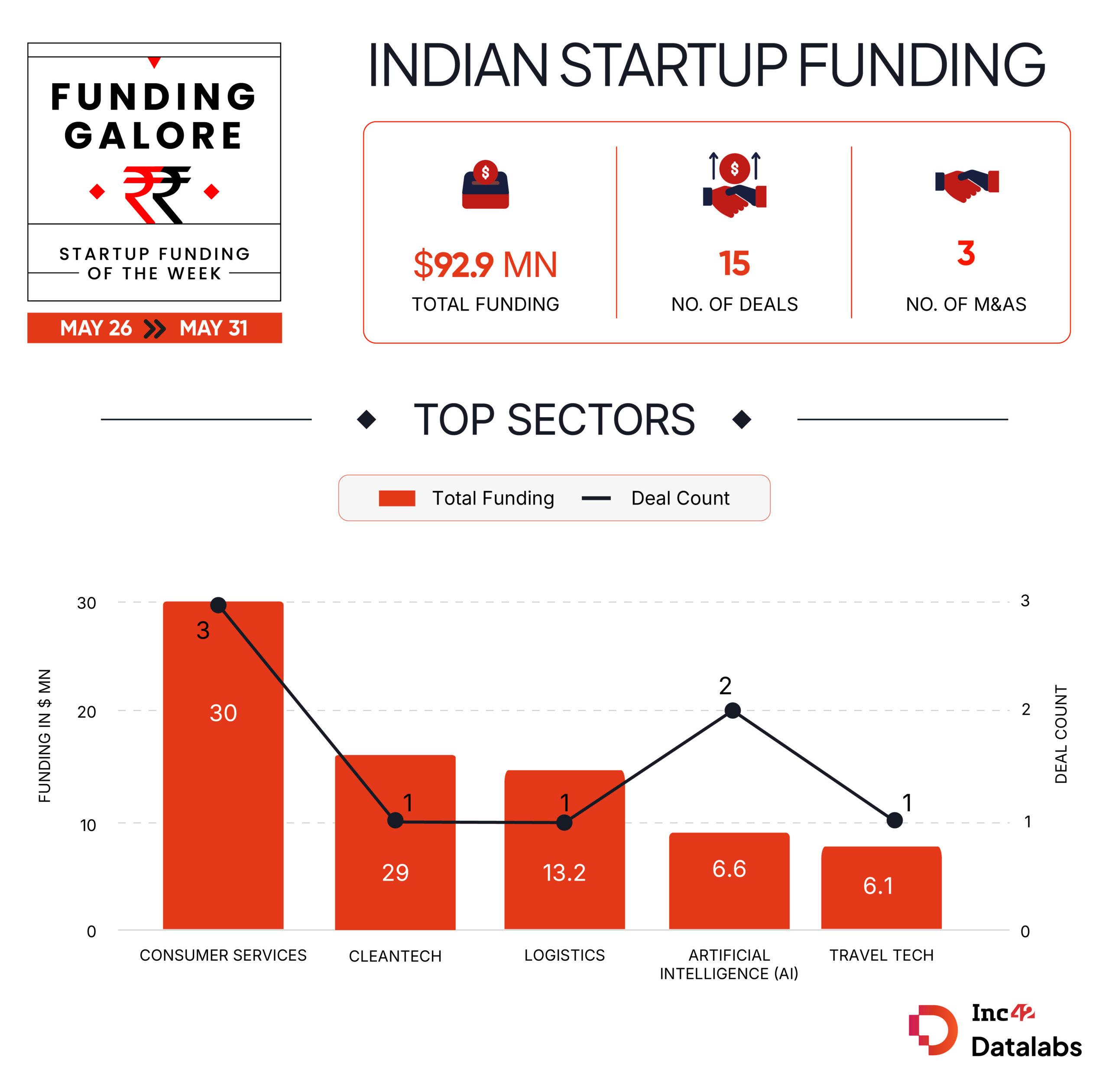

Between May 26 and 31, 15 startups managed to raise $92.9 Mn, marking a 60% decline from the $231.7 Mn raised across 16 deals last week.

However, despite the muted funding trends, the week saw the third Indian startup joining the unicorn race this year. Pet food startup Drools entered into the unicorn club via a secondary transaction that saw Nestle India acquiring a minority stake in it.

With that said, let’s take a look at the major developments that happened in the Indian startup ecosystem this week.

Funding Galore: Indian Startup Funding Of The Week [ May 26 – 31 ]

| Date | Name | Sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors | Lead Investor |

| 30 May 2025 | Battery Smart | Cleantech | Electric Vehicle | B2B-B2C | $29 Mn* | Series B | Rising Tide Energy, responsAbility, Ecosystem Integrity Fund, LeapFrog Investments | Rising Tide Energy |

| 29 May 2025 | Snabbit | Consumer Services | Hyperlocal Services | B2C | $19 Mn | Series B | Lightspeed Ventures | Lightspeed Ventures |

| 27 May 2025 | Fleetx | Logistics | Logistics SaaS | B2B | $13.2 Mn | Series C | IndiaMART Intermesh, BEENEXT Accelerate Fund | IndiaMART Intermesh, BEENEXT Accelerate Fund |

| 27 May 2025 | Slikk | Consumer Services | Quick Commerce | B2C | $10 Mn | Series A | Nexus Venture Partners, Lightspeed Ventures | Nexus Venture Partners |

| 30 May 2025 | Chalo | Travel Tech | Booking Services | B2C | $6.1 Mn | – | Filter Capital, Mohit Dubey, Priya Singh, Vinayak Bhavnani | – |

| 27 May 2025 | Frinks AI | Artificial Intelligence (AI) | Application Layer | B2B | $5.4 Mn | Pre-Series A | Prime Venture Partners, Chiratae Ventures, Navam Capital, Ashok Atluri | Prime Venture Partners |

| 28 May 2025 | GROWiT | Agritech | Agri & Farm Inputs | B2B | $3 Mn | Series A | GVFL, Veloce Opportunities Fund, JITO, We Founder Circle, Sunicon Ventures Fund, Progrowth Ventures, Hyderabad Angels | GVFL |

| 27 May 2025 | EUME | Ecommerce | D2C | B2C | $3 Mn | Series A | Ashish Kacholia | Ashish Kacholia |

| 27 May 2025 | Contineu.ai | Artificial Intelligence (AI) | Application Layer | B2B | $1.2 Mn | Seed | SenseAI Ventures, Piper Serica Angel Fund | SenseAI Ventures |

| 29 May 2025 | KhiladiPro | Consumer Services | – | B2C | $1 Mn | – | Shastra VC, MGA Ventures | Shastra VC |

| 29 May 2025 | Cleevo | Ecommerce | D2C | B2C | $1 Mn | Seed | Eternal Capital, Utsav Somani, Suhail Sameer | Eternal Capital |

| 28 May 2025 | Orbitt Space | Deeptech | Spacetech | B2B | $1 Mn | Pre-Seed | pi Ventures, IIMA Ventures | pi Ventures |

| 27 May 2025 | TOVA | Ecommerce | D2C | B2C | – | – | Poonawalla Group | Poonawalla Group |

| 29 May 2025 | GydeXP | Travel Tech | Booking Services | B2C | – | pre-Seed | Rukam Sitara | Rukam Sitara |

| 29 May 2025 | Ziniosa | Ecommerce | D2C | B2C | – | – | Inflection Point Ventures | Inflection Point Ventures |

| Source: Inc42 *Part of a larger round **Included this week as it was skipped last week *** Includes both primary and secondary deal Note: Only disclosed funding rounds have been included |

||||||||

Key Startup Funding Highlights Of The Week

- On the back of Snabbit and Slikk’s fundraises, consumer services emerged as the most funded sector this week with three startups in the sector cumulatively bagging $30 Mn.

- Buoyed by Battery Smart’s $29 Mn fund raise, cleantech emerged as the second most funded startup segment this week.

- The highest number of four deals materialised in the ecommerce segment, with startups raising a meagre $4 Mn. Two of the funding deals were undisclosed in the segment.

- Lightspeed Ventures was the most active investor this week, backing Snabbit and Slikk.

- Four startups at the seed stage raised $3.2 Mn this week, down significantly from $27.6 Mn raised by startups at this stage last week.

Fund Updates Of The Week

- PE firm Multiples marked the close of its $430 Mn continuation fund. The fund raised capital to acquire interests in Vastu Housing Finance Corporation, Quantiphi and APAC Financial Services.

- World Bank’s investment arm International Finance Corporation proposed a $30 Mn infusion in India-focussed consumer fund L Catterton India Fund. The fund is targeting total commitments of up to $600 Mn.

- Info Edge received shareholder approval to invest up to INR 1,000 Cr in its latest startup-focussed fund, Info Edge Venture Investment Fund III.

- Healthcare-focussed PE firm Quadria Capital announced the final close of its Fund III with $1.1 Bn in total commitments. The firm plans on backing approximately 10 “market-leading” healthcare companies in high-growth sectors like specialised care and pharma manufacturing

Startup IPO Developments This Week

- Investment tech Groww took the confidential route to file its IPO papers with the SEBI this week, making it the third startup to file its DRHP confidentially this year. The company’s IPO size is estimated to be in the range of $700 Mn to $1 Bn.

- Taking the first step towards its public listing, SaaS unicorn Amagi converted into a public entity by dropping the word “private” from its name.

- Razorpay completed its reverse flip to India this week, merging its Delaware-registered parent entity with Indian subsidiary, Razorpay Software India Pvt Ltd.

- In the run up to its $400 Mn IPO, fintech unicorn Moneyview has changed the name of its parent company from Whizdm Innovations Pvt Ltd to Moneyview Pvt Ltd.

M&As This Week

- Imarticus Learning acquired Bengaluru-based edtech platform MyCaptain for INR 50 Cr in a cash and stock deal.

- KiranaPro bought AI-powered platform Likeo for $1 Mn to bring virtual try-ons offering to its consumers.

- Open-source project management platform Plane acquired US-based enterprise tech company Sort in an undisclosed deal.

- CCI cleared Jumbotail’s proposed acquisition of Solv India this week. Reports estimate the buyout to cost the acquirer $50 Mn.

Other Developments Of The Week

- After raising $2 Mn earlier this month, home services startup Pronto is now in advanced discussions with investors to raise about $12 Mn in Series A funding.

- D2C startup Snitch is in the process of raising over $33 Mn in its Series B funding round from investors like 360 Asset Management Fund, IvyCap Ventures and SWC Global.

- Quick fashion startup KNOT is in talks to raise about $3 Mn in its maiden funding round led by Kae Capita.

- Lendingkart is likely to raise a debt of about $12 Mn from InnoVen Capital soon.

The post From Battery Smart To Chalo — Indian Startups Raised $93 Mn This Week appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media