[[{“value”:”

Zepto Delays D-Street Drive

Taking a U-turn from its plan to go public in 2025, Zepto has deferred its IPO plans by a year. With this, the quick commerce juggernaut has joined the likes of Zetwerk, OYO and PayU India, who are also playing a wait-and-watch strategy before parking at the D-Street.

Notably, Zepto was initially targeting a $450 Mn public issue but later increased the issue size to $800 Mn to $1 Bn.

Why Defer Now? While adverse markets are somewhat to blame, Zepto is also said to be looking to reduce its cash burn and improve its profit profile before hitting the exchanges. However, Zepto CEO and cofounder Aadit Palicha has hinted that the startup will file its DRHP with SEBI later this year, implying a 2026 listing.

The Profitability Puzzle: Zepto’s apprehensions are not without reason. The company clocked a loss of INR 1,248.64 Cr in FY24 against an operating revenue of INR 4,454.52 Cr, up 2X YoY.

Eating into this healthy top line has been the intensifying quick commerce wars, which have forced the company to splurge heavily on opening new warehouses, enter new cities and offer discounts to woo and retain customers.

In Murky Waters? The timing also seems to be a little tricky for Zepto, as the company has been embroiled in a slew of controversies recently.

Much has also been denting the company’s image, including the revocation of the food business licence of its warehouse in Mumbai’s Dharavi over serious food safety violations, the shut down of 44 Zepto Cafe warehouses due to supply chain constraints, rising complaints, a potential antitrust case, employing dark patterns and auto-activating ad campaigns for inactive brands without seller consent.

Given the current scheme of things, Zepto, like many others, is delaying its D-Street drive.

From The Editor’s Desk

Snitch’s INR 500 Cr Revenue Run: Snitch scaled its net sales from INR 11 Cr in FY21 to INR 243 Cr in FY24. The brand crossed the INR 500 Cr revenue in FY25. So, how did a pandemic product grow up to become a clothing brand that today locks horns with H&M and ZARA?

WazirX Escapes Singapore Crypto Noose: The crypto exchange has incorporated an entity in Panama to keep running its crypto business without the need for a licence from the city state. The move follows Singapore’s tightening of the regulatory noose around crypto transactions.

NCLAT Refuses Relief To Gensol: A Delhi bench of the appellate tribunal has rejected two pleas filed by Gensol-linked entities, BluSmart Premium Fleet and Matrix Gas and Renewables, seeking a stay on the freeze of their assets ordered by an Ahmedabad bench of the NCLT.

Naagin Bags $2.1 Mn: The hot sauce startup has raised $2.1 Mn in its latest funding round led by 360ONE Asset, with participation from existing backer 8i Ventures and a clutch of undisclosed angel investors. Founded in 2019, Naagin sells chilli oil, pizza-pasta sauce and salsa.

CoinDCX CTO Quits: Vivek Gupta has resigned as the crypto exchange’s chief technology officer after a five-year-long stint. Gupta’s next move remains unknown so far. The unicorn’s head of legal affairs, Tushar Tarun, is also on his way out and is serving the notice period.

Why Is Quick Fashion Hot Right Now? India’s quick commerce economy has a new darling. Quick fashion platforms such as Slikk, Blip and NEWME are building up momentum and banking on VC funding to disrupt Myntra and AJIO. But does this new wave really make sense?

Inc42’s Unicorn Tracker: India’s startup ecosystem has seen 122 startups enter the unicorn club to date, collectively raising over $115 Bn and amassing a combined valuation of more than $363 Bn. India has added three unicorns to its kitty so far this year.

Tesla Ramps Up India Strategy: Elon Musk-led EV maker has leased a new warehouse space in Mumbai’s Kurla West as a part of its strategy to expand operations and build an ecosystem for future manufacturing and supply chain activities in India.

Inc42 Startup Spotlight

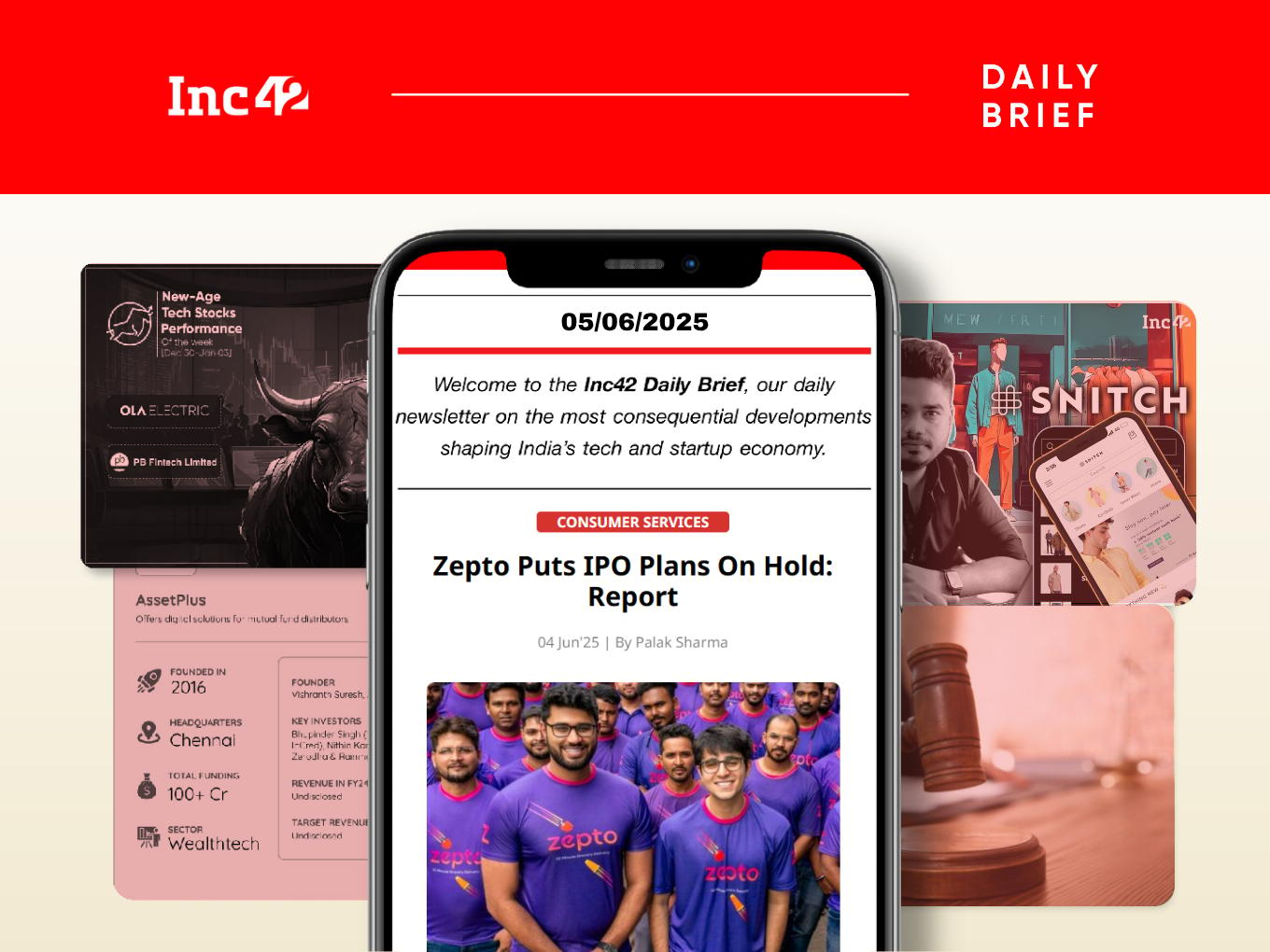

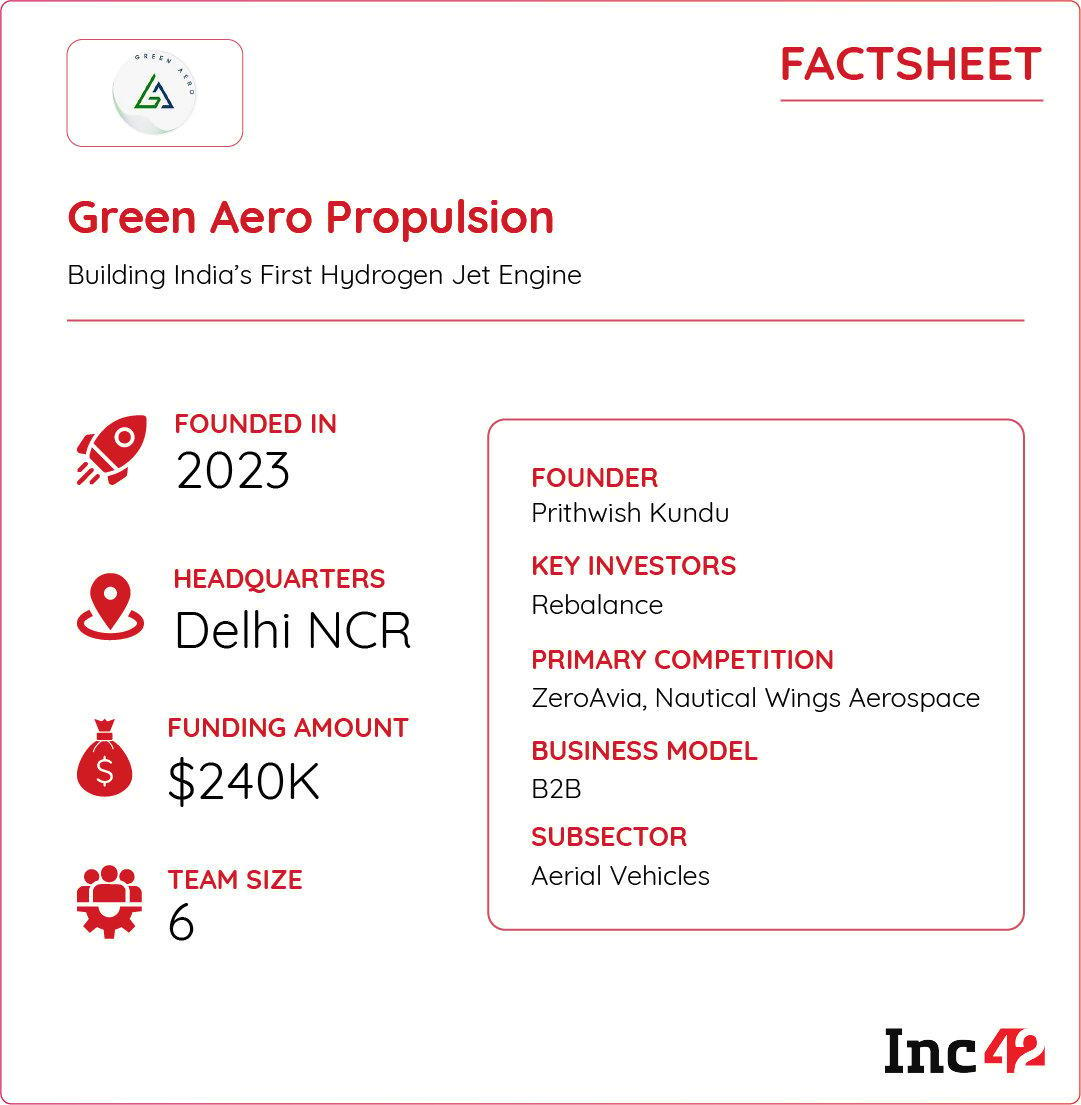

Can Green Aero Propulsion Decarbonise Aviation And Shipping Industries?

Aviation and shipping sectors together produce nearly 10% of global carbon emissions. But reducing these emissions is tough because both industries rely heavily on fossil fuels and outdated engine technology.

Founded in 2023 by Prithwish Kundu and Anushila Chatterjee, Green Aero Propulsion is working to change this. The IIT Delhi-incubated startup is developing hydrogen-powered propulsion systems and advanced gas turbines to replace traditional engines with cleaner and more efficient alternatives.

A Dragon Is Born: In May 2025, the startup successfully tested The Blue Dragon, its first hydrogen-powered jet engine. With rising global pressure to cut emissions and a growing focus on defence innovation, Green Aero’s technology has huge potential across both the energy and aerospace sectors.

Green Aero is building propulsion systems that are not only cleaner but also high-performance. Its work directly supports India’s goals in defence and climate action, giving the startup a strong foundation to scale and make a lasting impact. Can it spark a revolution to decarbonise the world’s toughest sectors?

The post Zepto Hints At A 2026 Listing, Snitch’s INR 500 Cr Revenue Run & More appeared first on Inc42 Media.

“}]]

Read More  Latest Startup News From The Indian Startup Ecosystem – Inc42 Media

Latest Startup News From The Indian Startup Ecosystem – Inc42 Media